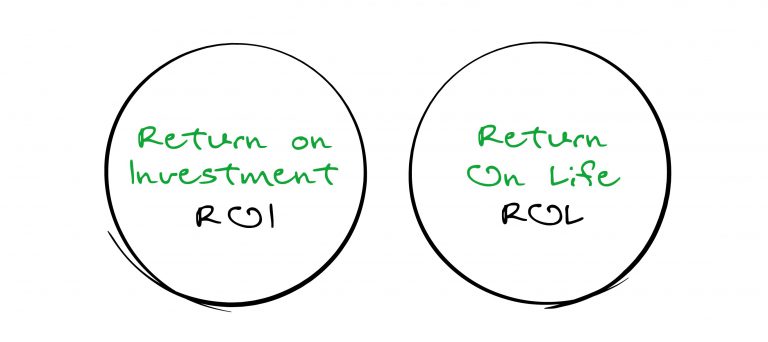

Return on Life (ROL) versus Return on Investment (ROI)

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

July 22, 2022 | 2 Minute Read

I got some interesting responses to last week’s Nano “The Coca-Cola Company and Lawyers”, so let’s connect this week’s Nano to the previous one.

Look at the above Sketch and Ponder over it.

What do you do for your Clients (Pick One)?

- Deliver a 15% return or whatever return

- Find the best product

- Time the Market

- Help them live the life they have imagined with their money.

Assuming you have answered the above, let’s now imagine that you have Aladdin’s magic lamp in your hands.

Rub the magic lamp and the Genie appears. Unlike the story, you are only granted 1 wish. The catch is that you have to make a choice between 2 wishes.

Option a. 15% return

or

Option b. Never have to worry about money and that you will have money when you need it

Which one would you choose for your children and family?

I can bet my life that all of us would Option b (only if you want to kill me would you choose Option a).

Yet when it comes to money, why is it that we think about a 10% or 15% or Highest return, when the purpose of money is to do Option b. A real financial professional or team will help clients exactly do that – help clients get clear about their values (purpose) and then find out what it takes to get them to never ever worry about money, and finally start making progress on that front.

Return on Life is all about helping people live the life they have imagined with their money.

The exceptional professionals of the future will invest their time and money in learning how to effectively deliver ROL to their clients. Not to mention, they are patient and understand the life cycle of a new project (read the Nano – The Valley of Death)

Are you?

P.S. I have given an entire blueprint on how to build the wealth management firm of the future in the book “The HappyRich Advisor.” If you haven’t got your copy yet, click here and order.

Similar Post

Nano Learning

The Magic of the Discovery Meeting

The discovery process is a crucial phase in any real financial professional-client relationship. By the way this is different from just a data gathering or fact-finding meeting...

21 June, 2024 | 2 Minute Read

Nano Learning

Return on Life (ROL) versus Return on Investment

Do you deliver a 15% return to your clients OR Do you help them live their Happiest Financial Life?

Help your Clients live their Happiest Financial Life (This is the Future of We ....

Read More

13 March, 2020 | Minute Read

Nano Learning

Become a World Class Editor

Scientific American recently had a post with this headline “Our Brain overlooks this Brilliant Problem-Solving Strategy”.

One of the key points of the post was “People of ....

Read More

23 April, 2021 | 3 Minute Read

Nano Learning

The Assumption Story

I had heard this true story somewhere though I do not recollect the exact source.

A Professor once told his student “Never work for a firm where there are no graduates (right o ....

Read More

4 June, 2021 | 3 Minute Read

Nano Learning

The Way to Price

Pricing is a complex subject (not to mention the creativity that is often required in it) and one that is rarely understood by most people. Knowing the costs of your services is no ....

Read More

20 May, 2022 | 2 Minute Read

Nano Learning

Skill > Knowledge

People often confuse between Knowledge and Skill.

I am sure you had a good look at the Sketch above.

You might have all the Knowledge in the world, but do you have the Skill to t ....

Read More

11 September, 2020 | 2 Minute Read

- 0

- 0

0 Comments