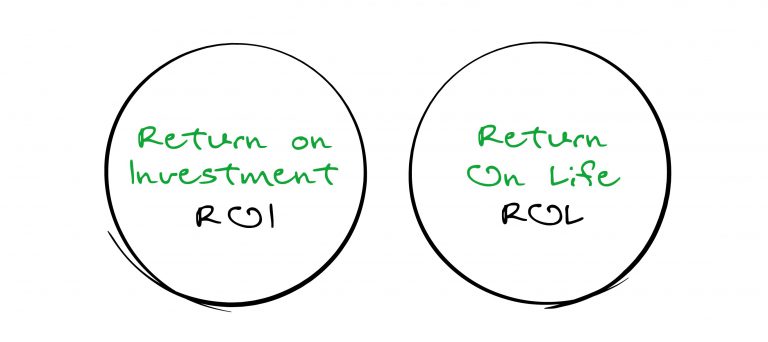

Return on Life (ROL) versus Return on Investment (ROI)

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

July 22, 2022 | 2 Minute Read

I got some interesting responses to last week’s Nano “The Coca-Cola Company and Lawyers”, so let’s connect this week’s Nano to the previous one.

Look at the above Sketch and Ponder over it.

What do you do for your Clients (Pick One)?

- Deliver a 15% return or whatever return

- Find the best product

- Time the Market

- Help them live the life they have imagined with their money.

Assuming you have answered the above, let’s now imagine that you have Aladdin’s magic lamp in your hands.

Rub the magic lamp and the Genie appears. Unlike the story, you are only granted 1 wish. The catch is that you have to make a choice between 2 wishes.

Option a. 15% return

or

Option b. Never have to worry about money and that you will have money when you need it

Which one would you choose for your children and family?

I can bet my life that all of us would Option b (only if you want to kill me would you choose Option a).

Yet when it comes to money, why is it that we think about a 10% or 15% or Highest return, when the purpose of money is to do Option b. A real financial professional or team will help clients exactly do that – help clients get clear about their values (purpose) and then find out what it takes to get them to never ever worry about money, and finally start making progress on that front.

Return on Life is all about helping people live the life they have imagined with their money.

The exceptional professionals of the future will invest their time and money in learning how to effectively deliver ROL to their clients. Not to mention, they are patient and understand the life cycle of a new project (read the Nano – The Valley of Death)

Are you?

P.S. I have given an entire blueprint on how to build the wealth management firm of the future in the book “The HappyRich Advisor.” If you haven’t got your copy yet, click here and order.

Similar Post

Nano Learning

The 2 Types of Clients

I came across this outstanding tweet that I am sure you will find super insightful.

This is simply spot on. A visual that explains the two types of clients extremely well.

We a ....

Read More

13 May, 2022 | 2 Minute Read

Nano Learning

Artificial Intelligence, a Financial Professional, and a Dog

Imagine a meeting room where an AI system, a financial professional, and a dog are present.

Someone might quip, “The AI is here to crunch numbers, the professional is here to un ....

Read More

19 April, 2024 | 2 Minute Read

Nano Learning

The Different ways we Pay

These are a few ways we pay in our business. Everyone has the option to pay with them.

Pay Money

Pay with Time

Pay with Mistakes

Pay with slow to no growth (except mark to mark ....

Read More

30 July, 2021 | 2 Minute Read

Nano Learning

Expand this Space

Even though I am tempted to write a few sentences, I stopped myself from doing so as this sketch needs no explanation.

What do you think? I know you will agree with me but even i ....

Read More

17 February, 2023 | 2 Minute Read

Nano Learning

The Two Basic Functions of Business

In his 1973 book “The Practice of Management”, Peter Drucker wrote these golden words: “The purpose of a business is to create and keep a customer.

1 September, 2023 | 2 Minute Read

Nano Learning

The Valley of Death

While the headline might come across as a bit odd, it will make sense as you navigate through this Nano.

Now Imagine yourself doing something new.

“What happens after you st ....

Read More

8 July, 2022 | 2 Minute Read

- 0

- 0

0 Comments