The Three Words

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

March 7, 2023 | 7 Minute Read

Are you wondering – what does he mean by the headline – what three words is he referring to? I bet you are. So, let me address this thought with another question. While the question will certainly give you the context of the post, I doubt you will be quickly able to come up with an answer (I have tried it with some of you before). But hey, you might just nail it. Alright, here comes the question.

“What are the three words that we (financial professionals) fear to say?

I am going to give you some time to think while I get my cup of coffee. But before that, let me give you some clues (it’s time to get the Sherlock inside you out).

What do we say when someone asks us this question “Where is the stock market headed?” Or for that matter another variation of this question “Is the stock market going up or down?”

Many of us start explaining the economy or what we think is likely going to happen in the stock market. We start throwing numbers. We start showing charts. We quote fund managers or rattle off portions of research reports. Some even use Monte- Carlo analysis. And if this was not enough, we even arrange for fund manager and stock market expert meetups for our prospects and clients. After all, who does not want to meet or hear the wisdom of the happening money managers? We do as many things as we can, but we don’t say those three words.

We don’t because we fear sounding like we don’t know our job. We fear that we might come across as idiots.

I have thrown in some serious clues in the above few paragraphs.

Did you get the answer yet?

I am guessing that many of you did. Even if you didn’t, here it goes.

The Three Words that we fear to say are – “I Don’t Know”.

We fear because we think it is our job to know the future. We fear because we think that investors think that it is our job to know the future. We fear that someone might actually think “Isn’t she/he supposed to know this?”

Thus, we end up engaging in time, energy, attention and brainpower (not to forget money) draining activities such as listening to quacks (aka prediction gurus), reading volumes of intellectual poison (aka most research reports), meeting market commentators and even pursuing some absolutely meaningless certification programs.

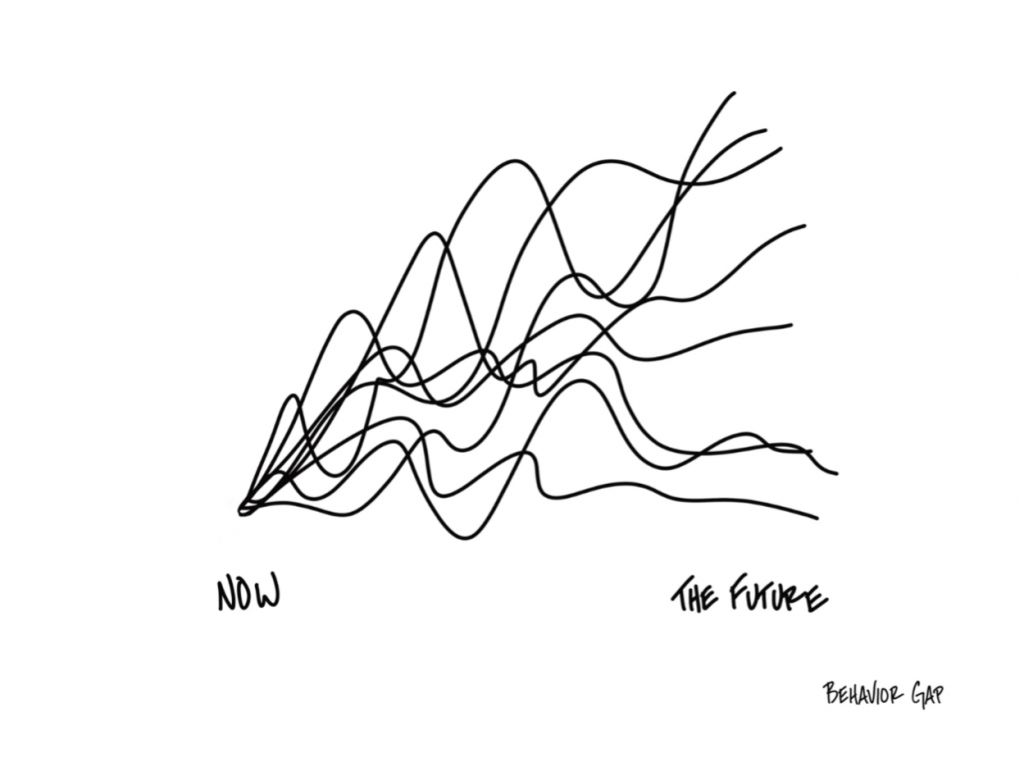

No matter what we do, we will never be able to predict the future. Forget us, no one else can predict the future too. And the most important truth is that “it doesn’t matter”. What matters is an investor’s ability to capture the growth of an economy (and the companies within it) and then to let compounding do its magic.

There is no need to worry about where the stock market is headed in the short term or whether this is the right time to invest or whether you have found the best investment.

So, Repeat after me: I. Don’t. Know. The. Future.

I. Don’t. Know. Where. The. Stock. Market. Is. Headed. Next.

I. Don’t. Know. When. The. Stock. Market. Will. Change. It’s. Course.

And finally: I. Can’t. Time. The. Stock. Market.

Sure, there are data models that may be 93.7% accurate 91.8% of the time. But there’s no such thing as a stock market oracle or crystal ball.

The stock market is not like gravity or even the weather. It doesn’t follow set laws.

On any given day, the stock market represents the collective feelings of all of us. More often than not, those feelings are based on emotions (rational or not). And it is only in hindsight that we recognize our mistakes.

So, while on one level, human behaviour seems predictable (e.g., we get excited and buy stocks when they are flying high; we get scared and sell when stocks decline), it’s awfully hard to know what we’re doing until it’s too late.

The basic facts though have remained the same. Over time (think 10, 15, or 20 years), stocks typically do better than bonds, and bonds typically do better than cash. We also know that a diversified portfolio will help protect you from the variability of the stock market. Typically.

Beyond that, stock market timing is just a guessing game, and we’re pretending to know something we don’t.

I have stopped pretending that I know.

Are you?

Because once we stop pretending, we can really focus on what’s important. We can focus on our real value proposition to our clients. We can focus on helping people figure out what is important to them about money. We can focus on having meaningful conversations about the intersection of their life and money as well as focus on delivering a world class client experience (and building a firm that our clients, team members and the world loves).

Ryan Holiday in his book “The Daily Stoic” wrote “One of the most powerful things you can do as a human being in our hyperconnected, 24/7 media world is say: I don’t know. Or, more provocatively: I don’t care. Most of society seems to have taken it as a commandment that one must know about every single event, follow the news religiously, and present them to others as an informed and worldly individual.

But where is the evidence that this is actually necessary? Is the obligation enforced by the police?”

Is the obligation enforced by the regulators? Or is it simply that you are just afraid of seeming stupid in front of prospects/clients or at a dinner party?

Imagine, how much time, energy, attention, money and sheer brain power would you have available if you cut down your economic and stock markets commentary and media consumption? How much of it all would you have if you simply could say, “I don’t know.”

The answer is a lot.

The question then is what would you do with all this surplus time, energy, attention, money and sheer brain power?

Similar Post

Featured

Beyond Data and Numbers: Mastering Discovery Meetings

Sunil, a long-time reader of this blog, wrote, “Amar, I know what a data gathering meeting is but what is this discovery meeting you wrote about last week. I got some sense, but ....

Read More

25 June, 2024 | 5 Minute Read

Featured

Amar Pandit + Carl Richards =?

Carl and I are super excited to announce the awesome work that we are doing for all of you. Yes, we have come together to help each, and every IFA build the firm of your dreams.

28 July, 2020 | 3 Minute Read

Featured

Love, Purple Cow and Angavastram

While the headline might seem a bit odd to you at first, there is indeed some connection among the words. Last week, I was in Chennai to attend “IFA Galaxy’s Summit 2023.” Be ....

Read More

28 February, 2023 | 6 Minute Read

Featured

The Meaningful Work You Do

Meaningful work is simple. It is any work that makes the world a better place.

It either reduces suffering or improves someone’s life. That’s it.

A doctor heals. A teacher educ ....

Read More

25 March, 2025 | 5 Minute Read

Featured

Unlocking Your Real Potential

The other day, I met an executive (Rahul- name changed) from an asset manager who told me something interesting: “Amar, the news is that Happyness Factory (HF) is buying MFD (mut ....

Read More

21 November, 2023 | 6 Minute Read

Featured

Not Just Another Relationship Manager

Jo had a meeting yesterday with a senior corporate executive.

Let’s call him Arup.

Smart, successful, articulate.

One of those clients who walks in with a certain air of confiden ....

Read More

13 May, 2025 | 7 Minute Read

- 0

- 3

0 Comments