The 4 Signals for you in the COVID-19 world

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

May 5, 2020 | 5 Minute Read

I had written a post called “The difference between Signal and Noise that you must understand” a couple of months back. You should revisit this to first understand the difference between signal and noise and then take stock of some of the signals that I had mentioned at that point of time.

Since then, the world has changed at phenomenal speed and there are new signals of what is happening right in front of us. There are many and I can’t possibly cover each one of them, but I have distilled the ones that have a direct impact on your business. Before jumping into the signals, let us quickly see how the world has changed for us.

For the first time in our lives, we have seen the following:

a) A complete lockdown of countries globally

b) Zero Economic Activity in many sectors

c) Oil Prices going below zero

d) 30 million Americans have filed for unemployment which is approximately 20% of their workforce. Similar credible data is not available for India, but we can see similar or worse trends here.

e) We are seeing the biggest central bank and government fiscal interventions worldwide. In the US, the first set of monetary and fiscal stimulus was around $4.3 Trillion which is around 124% of their government revenue in 2019 (and more is coming). We have seen negligible fiscal stimulus in India so far and everyone has been waiting for announcements for the last several weeks.

f) Escalation of geo-political tensions (US and China) or Oil Wars (Saudi Arabia and Russia). US and other countries are going after China as the cause of Coronavirus (generated in their Wuhan Lab).

g) Disruption in supply chains leading to shortages of supply for products everywhere and now demand side crisis because of the economic impact.

This means we have a pandemic, an equity market crisis, oil market crisis, bond market crisis, a currency crisis in the making, a supply and demand side crisis all at the same time.

In short, the world is changing at a faster pace than ever before. A few months back words such as contact tracing, social distancing and flattening the curve were not even a part of our vocabulary. I am sure this does not end here, and we will continue to learn new things.

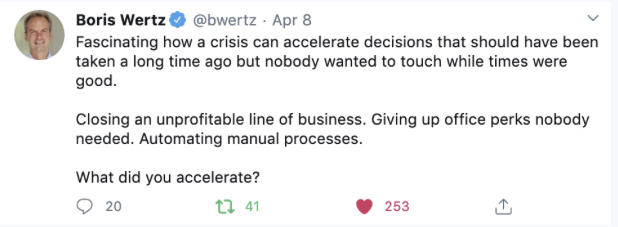

On the other hand, there are some things which are so obvious that should have happened are now happening because of the pandemic. I share a lovely tweet that captures what I was hoping to explain.

What are the signals that we are all witnessing?

1. Adoption of Technology is happening at a rapid pace by businesses:

We are seeing faster adoption of technology by Doctors as well as patients through Telemedicine(E-Health – Doctors using Technology to remotely diagnose patients) which was not given a priority earlier. Think about it in our industry /profession. If you were to conduct a meeting virtually, suddenly the entire country becomes your market and you are no longer restricted to geography. You can now deliver a fantastic client experience to your friend or a referral sitting in any part of the country. However, adopting technology does not mean switching on Zoom and starting off. It means thinking about how you move your process, workflow and most importantly your conversation online to deliver an awesome client experience. So, do not just think of technology for transactions, think of technology as a new way to run your entire business. In short, reimagine your entire business.

2. New Consumer Behaviours are shaping up and the biggest of them is Adoption of Technology:

Consumers are forced to try new things and they are getting comfortable with it. I see a lot of senior citizens get very comfortable with technology. I have seen my 72-year-old mother adopting Zoom (though she likes to learn new things) to connect with her friends.

People are far more open today for newer ways of doing things and some behaviours will be permanent. There will be limited gatherings, travel restrictions, social distancing to protect senior citizens and children, and hygiene requirements (washing hands, wearing a mask in public) that will be observed.

Remote Working and Adoption of Technology will be the trends of the future. All of these have a direct impact on your business and your business model.

3. People are thinking about saving for the future, investing, and more importantly planning:

The principle “Save for a Rainy Day”, and financial planning for the future is a thing on the minds of most people. People have lost jobs, taken pay cuts and even those who have not are thinking of saving and investing prudently (not to mention risk management).

Two of the most important words on top of every consumer’s mind is Security and Liquidity. People are not only worried about what is happening now but also about what is likely to happen. Thus, they are far likely to engage into meaningful conversations with you.

I have seen some of the busiest people who didn’t have time earlier to even think on this front (talking about people who have enough money) also thinking on navigating through this crisis, planning for the post COVID-19 world, preparing themselves better before the next crisis and looking for opportunities in that order.

4. Competition will be fiercer:

Like I have mentioned earlier, the wise IFAs are already engaging with prospects, their social network, and clients in a meaningful way. They are not waiting for the lockdown to be opened as they are seeing the broad signals that are happening and taking action to position them and their firms for success.

There are many more signals such as Revenue compression (because of market declines and debt crises) , Regulatory challenges and Robo Advisors (The 3 R’s of your problems) but they have been there for the last several years and will continue to be there. However, the 4 signals listed above are the most relevant for our profession considering what has happened in the last few months.

Like always, I will end my column with a fantastic quote by Jim Rohn: “At some point you either have the things you want or the reasons why you don’t.”

Similar Post

Growth

Are you doing Deep Work?

American Actor and Comedian Steve Martin was once asked for his secret of success “He said that there is no secret but if you are thinking how can I be really good, people will c ....

Read More

10 November, 2020 | 5 Minute Read

Growth

The situation an IFA faced last week that left him speechless

I am sharing a very interesting situation that you would find useful in your regular interactions with prospects and clients.

This one was from a very prominent IFA (Akshay- name ....

Read More

30 June, 2020 | 4 Minute Read

Growth

The key difference between outdated and current business models.

Last week, I wrote a post about how a gap in understanding can lead to serious business model problems for distributors as well as advisors. A couple of folks requested for some mo ....

Read More

22 December, 2020 | 6 Minute Read

Growth

The Grand Inversion

Though I knew this concept intuitively (as the design of the HF ecosystem has been based on this one), I found a fancy name for it when Mike Sha, Founder - SigFig (a US WeathTech F ....

Read More

21 June, 2022 | 5 Minute Read

Growth

The Next Smallest Action

I had thought of writing an interesting post (this week) with the headline “Are you TAMPing it?” As I started writing this, I felt that I had left a few thoughts incomplete in ....

Read More

13 September, 2022 | 5 Minute Read

- 1

- 0

0 Comments