The Patterns We See

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

February 8, 2022 | 5 Minute Read

Recently, I had a conversation with a senior executive from an asset management firm. He was explaining all the reasons why his firm’s funds had not performed for the last 2-3 years. He then talked about some research they had done and the interesting frameworks they had come up with. “All of this is back tested with data and goes to prove that our models will work”, he said.

I asked him, “What happened to your previous framework, QXLZ? Wasn’t this touted to be the greatest wealth creator framework of all times that worked during different time frames?”

There was silence for a few minutes as the previous pattern was laid to rest. We will now only hear about it the next time it starts working.

Patterns and Back Testing together create a potent investing thesis, that is first used to brainwash financial professionals followed by investors next. Whenever there is a new product, you can expect to hear a song around how wonderful these new patterns are. In reality, it’s simply an old sales technique that still works in the 21st century.

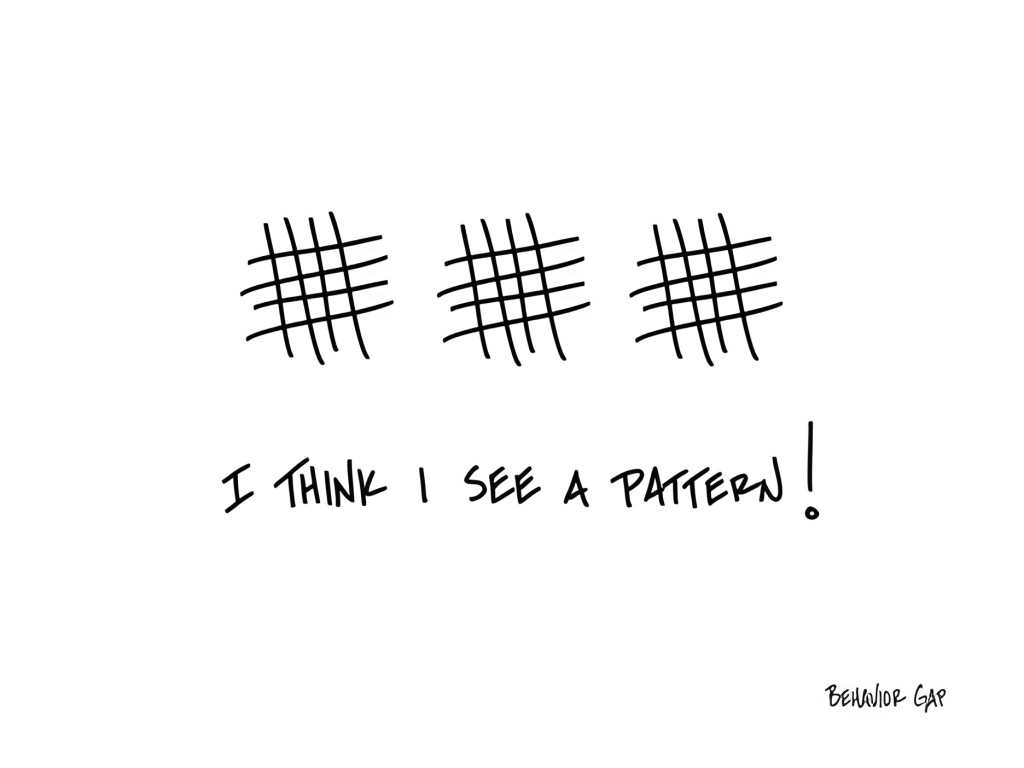

Have you ever thought that you are good at recognizing patterns?

I still think I can

We are all so good at recognizing patterns that we often see them when they don’t even exist.

During his research, David J. Leinweber of CalTech figured out how to predict the US stock market using just 3 variables:

- Butter Production in the United States and Bangladesh

- Sheep Production in the United States and Bangladesh

- Cheese Production in the United States

Isn’t this amazing?

What else do we need? Because it turned out that these 3 variables predicted 99% of the stock market’s movement!

Are you excited to see if there is a similar one for the Indian Stock Market?

Before you get all excited, there was just one problem: the joke’s on us.

While well-intentioned, the constant pursuit of patterns is one of the biggest behavioural mistakes we make time and again. Yes, we as financial professionals are guilty of this mistake. We look for patterns. And guess what, they absolutely exist. Right until we invest our money based on the pattern. Then all of a sudden, none of the patterns seem to work.

Now imagine something as mundane as driving.

Can you truly drive a car safely while looking in the rear-view mirror?

Investing based on back testing and patterns is similar to driving by looking into a rear-view mirror.

Let me ask you another question.

Will your drive today and exactly follow the path you followed yesterday?

Nope. You might have stopped at more signals. You might have encountered more traffic. A rash biker would have crossed the red light and come right in front of you. Just because you experienced it yesterday does not mean you will experience it today. It’s not the same day or the set of people on the road or the same environment. I believe you are getting the point that I am trying to make here.

This applies to the world of investing. The buyers and sellers are different every day. There are even different types of buyers and sellers each day each playing their different game. The News Flow is different. There are thousands of variables that have no correlation to each other that are at work. In short, everything is different. So, simply because it worked in back testing does not mean it will work in the future. For all practical reasons, it will simply not work.

Nevertheless, Patterns and Predictions are big business. They continue to be used by many salespeople peddling products. Many genuinely believe the patterns work. They think if something has worked in the past, then it will surely continue to work in the future.

They start to believe- that this pattern has predictive value.

But it doesn’t. And that’s the thing about most patterns – they never predict the future; they just describe the past. While some of the silly data mining tricks might be interesting to talk about, they don’t actually help our clients. And if they don’t help our clients, they can never help us. In fact, most of these are injurious to our client’s wealth and ultimately to us.

The Late British American Author, Christopher Hitchens, wrote, “Human beings are pattern-seeking animals who will prefer even a bad theory or a conspiracy theory to no theory at all.”

What do you think?

Do you see patterns?

If so, I would love to hear from you.

What are some of the interesting patterns that you have heard or observed lately?

Similar Post

Growth

The Secret to Explosive Growth

“I don’t want to collaborate,” said Ram, a financial professional in India managing Rs. 200 Crore (approximately $25 million) in assets. This sentiment, though common, is a s ....

Read More

9 July, 2024 | 5 Minute Read

Growth

WOOP It to Grow

Many of you might be wondering what WOOP is. The first word that comes to mind when we think of WOOP is Scoop. Let me not waste more words and tell you that WOOP is one of the most ....

Read More

27 October, 2020 | 5 Minute Read

Growth

Growth and Comfort Never Co-Exist

The Ex-Chairman of IBM, Ginni Rometty, once said something powerful. “Be prepared to spot growth opportunities when they present themselves because they are key learning opportun ....

Read More

2 September, 2025 | 6 Minute Read

Growth

A Rule For The Industry

I read a very interesting Bloomberg post “Two Rothschild Bank Clans Fight Over Clients, Power and the Family Name.” The explanation of this headline – The Swiss and French br ....

Read More

9 April, 2024 | 6 Minute Read

Growth

These 2 things are costing you big time (without you even realizing it)

I have been personally interacting with a lot of distributors and advisors and so are my colleagues. Every firm is going through similar challenges. First it was the sharp market c ....

Read More

28 April, 2020 | 4 Minute Read

Growth

The Constraints that will change your Business and Life

Constraint is a noun and it generally means the state of being restricted or compelled to avoid. We think of constraints as something negative or bad for us. What if I told you oth ....

Read More

1 December, 2020 | 6 Minute Read

- 0

- 0

0 Comments