The Most Important Step in taking Technology Decisions

Satish Joshi

Satish Joshi is the Chief Technology Officer of Happyness Factory– A purpose driven AI company in the FinTech space (Wealth Tech). Prior to Happyness Factory, he was the Executive Vice-President and Global Head- Product Engineering Services of iGATE Corporation. He was also a member of the Executive Management Council of the corporation. In his previous roles in the company – then known as Patni Computer Systems Ltd. he was responsible for managing various service lines and practices such as Enterprise Applications, Infrastructure Management, Business Process Outsourcing, Business Intelligence etc. He was also the Global Head of Technology & Innovation, responsible for specialized enterprise-wide technology services, developing and driving R&D initiatives to provide cutting-edge business solutions using new /emerging technologies. Satish holds a Bachelor’s degree in Electrical Engineering and a Master’s degree in Computer Science from IIT, Mumbai.

January 20, 2020 | 6 Minute Read

Many years ago, I was in a discussion with the executive management team of a well known business house in India. Over the years they had inducted computing technology in many aspects of their business – Inventory management, basic accounting, invoicing and collections, payroll etc. The main subject of discussion in this meeting was – What next? The problem in answering this question with confidence however was; No one had thought of first asking “WHY” before getting on to “WHAT”?

When I asked but why did you decide to automate your inventory management by investing a considerable amount of money (at that time) in computers and software. The answers varied from “reduction in idle inventory carrying costs” to “reducing wastage of raw materials” to “reducing employee headcount engaged in this function”. So, the only common factor in these seemed to be cost reduction. However when I further asked whether as a result of this new system, their total cost of production had reduced or increased (for example did bringing down the idle inventory levels result into (as it potentially could) delays or stoppages on the shop floor leading to increased manufacturing cost), there were no clear cut answers.

The moral of the story is – Technology strategy is not just about selecting the best product or platform in the market to automate one or more tasks or business processes. First one must ask WHY is technology needed i.e which areas or activities in the business can truly benefit from induction of technology AND what specifically (in quantifiable terms) that benefit will be. Only after the answers to these questions are known should the search for the right product or platform should start.

In the life of an Investment advisor/Wealth Manager why is technology important? Where can it add the most value?

There is no “one-shoe-fits-all” answer to these questions. Therefore, I will start today with a broad-brush overview of how to determine the difference technology can make and over the course of the next few articles dive deeper into each area.

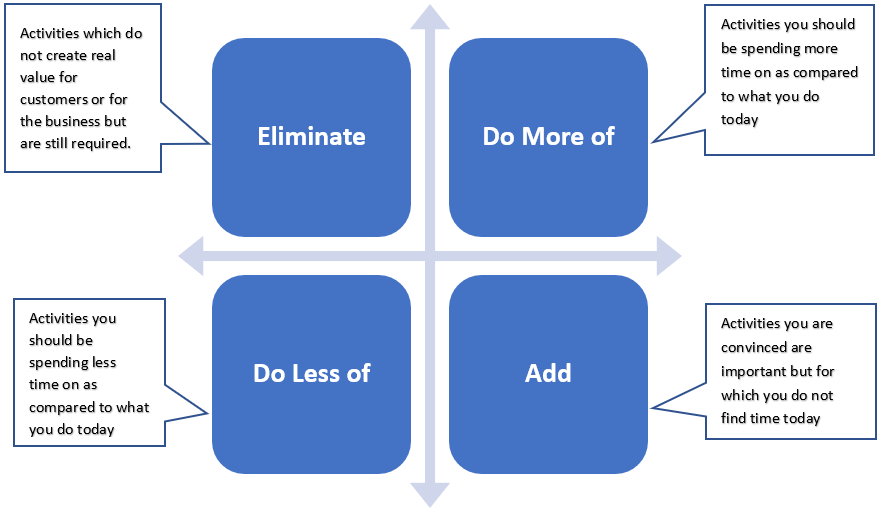

The first step in answering “where can technology add the most value?” is to determine if your (or your team’s) allocation of time and efforts to different business activities which you perform is commensurate with the value they create for you and your customers. A simple tool (see the picture below) can be used to answer this effectively, once the four lists – as explained in the picture below – are made.

The next task is to determine how can technology be leveraged to save your time which you are spending on activities listed in the “Eliminate” and “Do Less Of” quadrants. This is the lowest hanging fruit and therefore should be tackled first before moving on to more difficult activities in the remaining two quadrants. Typically, these will be routine activities which do not involve complex decision making and thus many of these can be completely automated using technology or reduced to technology assisted, standard operating procedures. Thus, saving considerable human effort.

For example, consider the act of signing up a new customer – AFTER you have done all the hard work of building a relationship, convinced the potential customer of the quality of service you can provide etc. First thing you will need to do is acquire all the information about the customer that is needed. This information will broadly fall in three categories –

- Information you need to be able to make a good investment plan such as the customer’s risk appetite, his/her existing assets, liabilities, cash flows, family goals etc.

- Statutory details such as PAN, KYC status, FATCA details etc.

- Logistics details such as address, email, phone numbers, Bank account details etc.

The first question is – Do you have a standard, well defined process to collect this information efficiently starting with a comprehensive checklist of what is needed?

Secondly and in fact more importantly, do you have an efficient process for storing and maintaining this information? Because all of this information is variable – people change addresses, bank accounts, tax residency status, acquire new assets or incur new liabilities, all of this information if not kept always up to date could severely affect your ability to service your customers.

Thirdly and even more importantly, do you have an efficient process to access this information at the right time? For example, the information you have collected indicates that the customer is going to receive a large bonus 6 months later. If you manage to remember this and contact the customer pro-actively at the right time with the right recommendations, he/she may invest this money through you. If you fail to contact the customer at the right time, this opportunity may just get lost.

Doing ALL of these tasks (and there is a much longer list of such tasks) correctly and efficiently is critical but all of this falls in the category of basic hygiene of carrying out your business. At the same time ,all of these tasks are routine and straight forward, do not require complex decision making. And most importantly simple technology tools for managing such data, maintaining a library of documents electronically, generating simple reminders, searching for required information quickly are available for practically no cost and can save considerable time and efforts which can be deployed for more value addition to your business.

However while selecting technology to do this, it is important to remember that

(a) The primary goal is to save time, labor and cost of acquiring and maintaining required information And (b) equally importantly, be able to access (almost) instantly, exactly the required piece of information whenever the occasion demands. Often selection is governed by the first and not the second criteria and that defeats the purpose.

In the third step, we start evaluating activities in the “Do More of” quadrant. Typically, these will be activities related to customer acquisition, relationship management etc. or activities which require complex decisions to be taken. And while activities in this list cannot be automated with technology completely, usage of technology can still create considerable value.

For example, consider the process by which you come up with an investment plan for your customer. This is not a routine, standardized process (or at least it should not be) because each customer’s circumstances, needs and aspirations are different. And ideally all of those should be factored in the plan. To make an intelligent plan the most important input is information, from a variety of sources – customers themselves, financial markets, regulatory agencies, tax laws etc.

This list can be long, the volumes large and the diversity can be daunting. But with the world getting more and more digitized, availability of the data is no longer a problem. Identifying what is relevant and what is not relevant and distilling down the large volumes to usable information is however a challenge that will get bigger by the day. This is the crucial help technology can provide – analysis and abstraction of only relevant information, correlating external information with customer’s needs (e.g. finding the best match between investment vehicles such as mutual funds and customer’s goals and risk appetite) or distilling down historical experience to evolve empirically validated rules which can be applied to make decisions instead of just relying on hunch and intuition. The technology to help you do all that exists but at this stage it starts getting complicated perhaps expensive and needs to be learned with some efforts to be able to use it effectively. So this calls for upfront investments of both time and money but the rewards to both your business and your customers can be substantial.

The fourth step is looking at activities in the “Add” quadrant. Typically, these would be related to completely new initiatives you have always wished to embark on or innovations you have always wanted to create but never found the time for. These may be related to offering new products and services, new partnerships, expanding into new markets etc. These are truly strategic activities and technology can play a great role in enabling you with information, analysis, what-if modelling and in helping create entirely new business models which are not possible without appropriate technology. But this is the most difficult application of technology and will require you to look at your business strategy to be put in place before trying to select, acquire and deploy technology. Without a well thought through business strategy in place, investments in technology could just turn out to be a waste.

We will discuss in detail each of these steps in subsequent articles.

I hope you loved this post. Feel free to share it with your fellow IFA colleagues and friends.

My objective here is to add real value to as many IFAs as possible and help you build the wealth management firm of the future. Let me know your thoughts and if there any topics that you would like me to cover.

Similar Post

Technology

TechFin and FinTech

What do you think is the difference between these 2 words “TechFin and FinTech” or are they one and the same?

Well, they are not.

TechFin’s are essentially Big Technology c ....

Read More

4 April, 2022 | 5 Minute Read

Technology

First-Rate Intelligence

Have you heard the Aesop’s fable (story) of the father, son and their donkey? If not, here it goes.

9 August, 2022 | 5 Minute Read

Technology

Cultivate This Superpower

In their book, "Why business people speak like idiots", Authors Brian Fugere, Chelsea Hardaway, and Jon Warshawsky shared a transcript, “

June 17,2003

CNN Moneyline with Lou D ....

Read More

3 June, 2025 | 7 Minute Read

Technology

Investment in Technology versus Digital Transformation

Do the 2 parts in the above headline seem similar to you?

I often see many getting confused between an Investment in Technology and Digital Transformation.

An investment in Techn ....

Read More

24 August, 2021 | 7 Minute Read

Technology

Overwhelmed with all the Software Choices - 3 Key Things to Follow

The other day I met a Financial Planner who had just attended a conference. He met up with so many technology vendors that he was totally confused about which technology to use and ....

Read More

11 February, 2020 | 10 Minute Read

Technology

The Caveman and THOG

I might not be able to find better words for the feelings and thoughts that are going through my mind now. I was thinking about a way to communicate this concept and I stumbled upo ....

Read More

28 September, 2021 | 5 Minute Read

- 4

- 2

0 Comments