The Future of our Industry

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

December 14, 2021 | 6 Minute Read

A short quiz first. No Googling ☺.

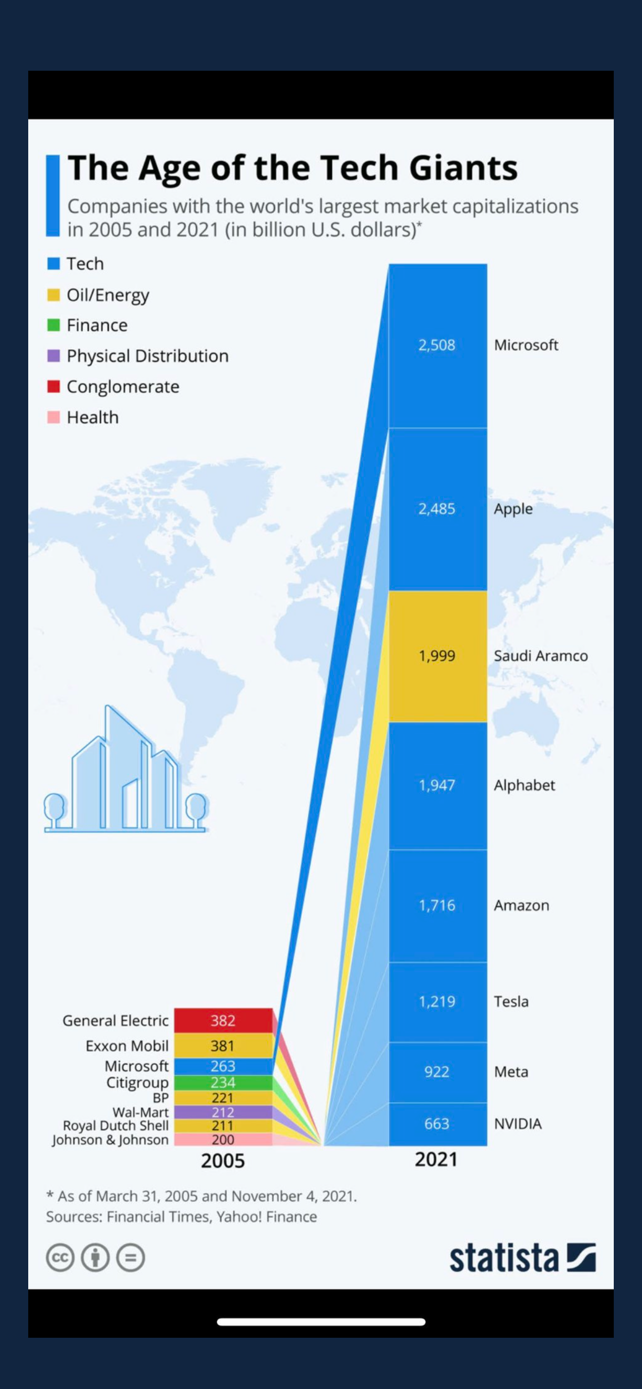

Can you guess the top 8 companies in the world by market capitalization in 2005?

Now, can you write down the top 8 companies in the world by market capitalization in 2021? Chances are you will find the 2021 names easier than the 2005 ones.

Either way, here is the answer in the form of a powerful visual.

By the way, the above chart is as of November 4, 2021. As of yesterday, Apple was close to becoming the first $3 trillion company by market capitalization.

I won’t be surprised to see a $5 trillion and $ 10 trillion company in the next 5-10 years respectively. Anyway, let’s not digress.

What are you seeing in the above chart?

- Microsoft is the only common company between 2005 and 2021. All the others from 2005 do not make the 2021 list. Except for J&J and Walmart, the others are not even in the Top 50 list.

- 7 of the 8 companies are technology companies and they seem to have grown exponentially.

Needless to say, this is the age of the tech giants. Now we don’t know whether these giants will stay or will be replaced by other tech giants by 2035 but the point is that technology (and digital) companies are here to stay.

Look at some of the top firms in our industry. Besides the legacy banks and financial institutions, you will see many new technology names. Some of these will implode for reasons that are native to our industry (which I will discuss in a future post) but there are a few which are here to stay.

The financial services industry has always been a physical first industry. By this, I meant, everything was physical. Going to the branches to open accounts, update passbooks and the smallest of things were predominantly physical.

Look at the mutual fund distribution space of the 1990’s and even till 2007 (some even do it now). Physical forms of NFOs and existing funds were kept in slots in small offices like a local grocery store. Many of these were near railway stations in Mumbai so people could pick up and drop forms on their way back. Many enterprising distributors used to even distribute forms at railways stations with their ARN stamped. Forms were distributed with newspapers. In short, distribution was predominantly physical.

Digital started a few decades ago in the banking industry and was predominantly a supplement to the fundamental physical experience. Digital was thought of as a supplement to the Core Client Experience. Whereas slowly and now quickly, digital is replacing the physical experience and itself becoming the core experience.

The COVID-19 pandemic simply accelerated this trend.

In the new world, physical will become the supplementary experience to the core digital experience. This means reimagining a very different way of doing business.

This requires a complete reimagining, rewiring and digital transformation of your business. But first, this rewiring needs to happen in your brain. This is easier said than done and will require a thoughtful and intentional investment in yourself and your firm. Simply buying some pieces of software and convincing yourself you have done it is actually an expensive and mediocre way of doing things. You are leaving a lot of money and value on the table by thinking short term.

Another costly mistake that even seasoned professionals and firms have done globally is to think of digital as a self-service channel. People think of digital in terms of digital is this and physical is this. They tend to segregate the two. However, we should actually be thinking about digital as a place where we have to get better at interacting with our clients. Think onboarding a client or the first client meeting or regular check ins and so on.

Finally, digital was thought for millennials and Gen-Z. Thanks to COVID-19, Digital is no longer for any one group. Consumers of all age and income groups have started adopting digital. According to Doctor Kelli Keough, Head of Product at JP Morgan Wealth Management, in 2020 and 2021, digital usage was as high for billionaires and baby boomers as it was for millennials. It was similar for high-net-worth people and people in their seventies and early eighties. We have witnessed a similar experience in India.

Digital is no longer simply a channel meant for one group. It is also not just a channel for doing certain things.

It is a Core Capability that must be built by every firm that wishes to thrive in the future.

It’s become part of the way we do business and how we interact with our clients and how we deliver our value proposition.

How are you looking at Digital Transformation and Technology?

Similar Post

Growth

From Forests to Firms: Mycorrhizae as a Blueprint for Sustainable Growth

In their book, CEO Excellence – The Six Mindsets That Distinguish the Best Leaders from the Rest- Authors Carolyn Dewar, Scott Keller, and Vikram Malhotra wrote, “Walk through ....

Read More

2 July, 2024 | 5 Minute Read

Growth

The 7 Habits

Author John Maxwell (an authority on leadership) wrote “People don’t determine their future. They determine their habits, which determine their future.” In short, if you wan ....

Read More

11 January, 2022 | 6 Minute Read

Growth

The Secret

I think the open rates for this post will likely be higher. After all, we love secrets, magic pills, tips, tricks and hacks. And while there is indeed a powerful secret, there are ....

Read More

9 May, 2023 | 6 Minute Read

Growth

The Virtual Hat-trick

Vinay Sikka is a very sincere Mumbai based IFA with around 150 families as clients and Rs.30 Crore of Assets Under Management. Though he was working very hard for the last 10 years ....

Read More

2 June, 2020 | 5 Minute Read

Growth

The 7 Habits

Author John Maxwell (an authority on leadership) wrote “People don’t determine their future. They determine their habits, which determine their future.” In short, if you wan ....

Read More

11 January, 2022 | 6 Minute Read

- 0

- 0

0 Comments