The Centaur Way

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

July 18, 2023 | 5 Minute Read

What comes to mind when you hear the word “Centaur”?

For Mumbaikars, the word “Centaur” reminds us of either the erstwhile Centaur Hotel (Sahara Star in its current avatar today) or the Juhu Centaur hotel…But in Greek Mythology, the centaur is a half man, half horse creature living in the mountains of Thessaly. Now that I have given you a hint about centaurs, let me ask you a question.

Have you heard of centaurs in the world of chess?

Any chess players here…You would probably know…

To answer the above question, let’s jog our memory a bit.

In the early 1990’s, IBM had built a supercomputer called Deep Blue. According to Wikipedia, “Development of this machine began in 1985 at Carnegie Mellon University under the name Chip Test. It then moved to IBM, where it was first renamed Deep Thought, but then again in 1989 the name was changed to Deep Blue.”

Image Source – Wikipedia

Ok so what’s so special about Deep Blue?

Deep Blue was best known for winning chess matches against the reigning world chess champion, Grandmaster Garry Kasparov. In 1996, Deep Blue lost to Kasparov in the first 6 games. The upgraded 1997 version though beat Kasparov comfortably, winning two games and drawing three. Deep Blue’s victory is considered a milestone in the history of artificial intelligence. But there’s more to this Deep Blue story.

After Kasparov was beaten by Deep Blue, he had an idea. He wondered what would happen if humans and supercomputers could team up in chess. In 1998, he set up the first advanced chess match between himself and Veselin Topalov, where they were each paired with a powerful computer. This evolved into a freestyle chess tournament in the following years. In this freestyle tournament (2005), humans, computers, and teams of humans and computers were all allowed to compete.

If you didn’t make the connection yet, the team of humans and computers are known as Centaurs.

Do you know who the winner was in this tournament?

It was not “Hydra”, the world’s best chess supercomputer at that time. Even grandmasters didn’t win this tournament. The winner was not even teams of grandmasters and supercomputers.

Surprised…Shocked!

So, who was the winner?

The winner was a team of 2 amateur chess players (Steven Cramton and Zackary Stephen) and 3 ordinary computers. This centaur literally crushed all the competition.

Shocking, isn’t it?

How is it that two normal people paired with normal computers could beat super computers as well as chess grandmasters paired with super computers?

Mike Beneschan in his post “Centaurs are More Powerful than Computers” wrote, “In chess, there is a difference between strategy and tactics. Tactics are short combinations of moves to win advantages. Good players can memorize thousands of tactics and board positions, but computers are immensely better than us at memory. Strategy, on the other hand, is understanding the big picture of the chess game, managing the small battles so you can win the big ones. Humans are better at strategy than computers.

The centaur team did not beat the chess supercomputer Hydra because of better tactics, but because of softer skills, the skills humans do best. Kasparov noted that the humans in the centaur team were the best at coaching multiple computers to get the best answer.”

Their success was attributed to a set of skills that had little or nothing to do with playing chess. Their skill that best augmented the tactical prowess of the computer was their ability to uncover, digest and distribute information.

Mike added, “When Deep Blue beat Kasparov, it showed the strength of computational power. But when a centaur beat Hydra, it showed the strength of humans doing what humans do best.”

The same applies to the work you do.

The soft side is always the hard side, more so in our industry/profession. As I have often repeated, “Personal Finance is more about Personal than it is about Finance.”

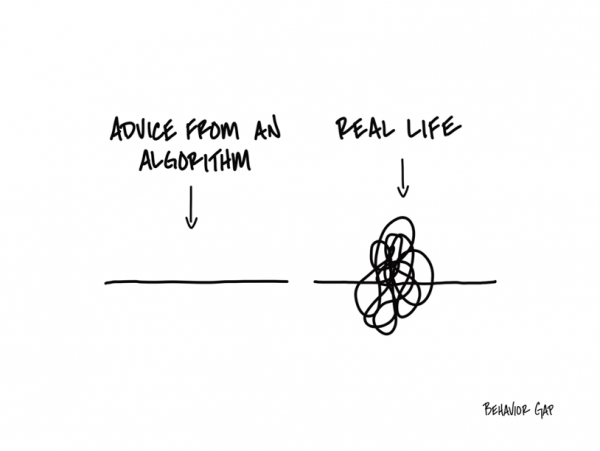

Your work centres around the intersection of humans, money, and life (not to mention emotions, biases, blind spots and behaviour). Computers can solve for what’s already answered. By this I mean computers can perform the most complex calculations in a few nanoseconds. Any tactical advantage will be nullified by a machine. But can any algorithm or AI program tell you how Raju is likely to react to the stock market going up or down tomorrow. The answer to this is not fixed. A computer can only answer when it actually knows the answer, but Raju’s (or our) assumptions, biases, blind spots, and behaviour are not programmed in any supercomputer.

Thus, real financial professionals too work on building the following skills – asking great questions, having amazing first meetings, listening, having powerful conversations, storytelling – from a perspective of building a very strong emotional connection and trust with their clients /prospects.

The reality is that humans don’t fit into an algorithm.

This is especially true when we’re talking about humans, their money and their lives.

“Humans + Money” is a messy little cocktail that economists refer to as a complex adaptive system. It’s complex because cause and effect can only be identified with the benefit of hindsight, and it’s adaptive because our interaction with the system changes it.

Try cramming that into an algorithm.

As much as we would all love a simple formula to tell us what to do with our money, the more we try to fit the big money questions into a neat little box, the more we find ourselves saying, “It depends.“

The only way to navigate in a complex adaptive system is through constant course corrections. Assess, guess, act, repeat.

Of course, the cycle rate for these steps is driven by the volatility of your situation. If the situation is relatively stable, you may only cycle through every six months. But when things blow up, you may be cycling through your financial decisions every day.

Life, stock markets, and money are messy. The human side of money thus will be the most important skill.

So, make yourself as adaptable as you can. The important thing is to remain flexible.

The future winners in our profession will also be centaurs…At the same time, anyone can become a centaur… A team of normal people and technology…The only thing I would add here is not just any piece of technology but a technology that blends with your humanness to deliver a wow client experience.

What if I told you that your neighbour, whoever that is… armed with the right client experience technology can be a better financial professional than you are.

No way right…

That’s what the grandmasters thought too.

P.S. To know how you can become a Centaur , write to us on: mfd@happyrichadvisor.com

Similar Post

Featured

Amar Pandit + Carl Richards =?

Carl and I are super excited to announce the awesome work that we are doing for all of you. Yes, we have come together to help each, and every IFA build the firm of your dreams.

28 July, 2020 | 3 Minute Read

Featured

This Magic Pill will solve all your problems...

Tell me if this sounds familiar.

● You are wasting time working with too many non-ideal clients who blame you for everything that ever goes wrong.

● You aren’t sure ....

Read More

3 August, 2021 | 6 Minute Read

Featured

Why Your Practice Valuation Isn’t Comparable to an Asset Manager’s?

Valuing a wealth practice is a nuanced and complex process. But one of the most common misconceptions among many distributors is this: “If an asset manager is valued at 4-5% of t ....

Read More

10 December, 2024 | 5 Minute Read

Featured

Why One Size Does Not Fit All in Personal Finance

Imagine walking into a store to buy clothes, but instead of picking garments that fit your size, style, and comfort, you choose to buy what your friend wears. It sounds absurd, doe ....

Read More

7 May, 2024 | 5 Minute Read

Featured

The Unbeatable Edge

I received a lot of love for the post “Knife in a Gun Fight”. At the same time, some of you had many questions. One reader wrote, “I lost 2 important clients to a bank and a ....

Read More

12 December, 2023 | 8 Minute Read

Featured

The Hardest Job in the Profession

The quote stopped me in my tracks.

“What is very easy? To advise another…

What is very hard? To know thyself.”

That’s Thales. One of the seven sages of ancient Greece. A ph ....

Read More

9 September, 2025 | 6 Minute Read

- 0

- 1

0 Comments