How can you double your AUM in 18 months?

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

January 3, 2020 | 6 Minute Read

I have been meeting IFAs of all sizes right from ₹25 Crore – ₹1200 Crore over the last few months. Very few of the firms that I met focus only on HNIs but the vast majority focused on all sizes of customers.

It’s been a very enriching experience meeting so many people doing interesting and different things. However, there was one thing which seemed to be very common amongst almost all of them. It was the phenomenal growth opportunity that each one had without even adding a single client. Surprised by this line? Well, don’t be and the opportunity is real. Read on and I will explain what I mean by this.

One IFA that I met had 1000+ clients and ₹100+ Crore of Assets. Another had several thousand clients (6000 and some ₹900 Crore of Assets). The average client AUM in the first case was ₹10 Lakh and in the second case was around ₹15 Lakh. The key point here is not which IFA and which city, etc. but the numbers underlying the business

Let’s do the math for your firm. How do the numbers stack up? I want you to note these numbers down

- Number of Clients

- Total AUM

- Average AUM per Client

I then asked these firms “Do you have 100% of your Client Assets?” There was silence because most of them didn’t know. Some reluctantly but appearing to be confident said, “Yes …we have”. Deep inside even the ones who said “Yes” know that the real answer is “NO”.

Now ask yourself, “Do I have 100% of my Client Assets?”

Think about it, why do you not have 100% of Client Assets? One reason is that you have made a product or a transaction pitch to your client. The second could be that the client might not trust you with 100% of his/her assets. The real reason is that most people in the business are not sure of how to go about it. Additionally, prospects and clients are not sure about who to TRUST.

I have always found this interesting. We have one architect/designer for our house, we have 1 doctor for our heart or 1 doctor for any specialization but when it comes to money, most prospects have 3-4 advisors. It’s like hiring one designer for your living room, another for your bedroom, a third for your kitchen and so on. This is the stupidest way of designing your house. Yes, you can always take a second opinion but you will first spend your time in finding the right architect for your house.

Likewise, the key time that clients should spend is to evaluate the right advisor for them. However, this is easier said than done and thus clients end up doing some form of Naïve Diversification- Have More Advisors. Spread your investments across more advisors (Just some form of Risk Management). The best and funniest part is when some so-called expert investors tell you “I will give you X amount of money. Let me see how you perform.” I am sure you have come across this. People do this because they do not know who to trust and IFAs accept this thinking, “I will prove my worth, beat the market and so on.” However, this a recipe of disaster and I will explain why as a different blog post because I do not want to digress from the key message here.

The key point here is that every IFA that I have come across can double their AUM within 18-24 months max (Most can earlier). In fact, the industry can double their AUM in 24 months if they focused on the right metric. So far the metrics for you and the industry are Number of Investors and AUM.

The Right metric for all of us is “Do we have 100% of the Client Assets”.

Now this will only happen if the client trusts you. The client will not trust you just because you are giving him a mutual fund or access to products or because you sound very intelligent. The client will only trust you when he knows that you are here to help him/her live his/her happiest financial life possible and that you will take care of him better than anyone else. This is not just a statement but a philosophy as well as a principle.

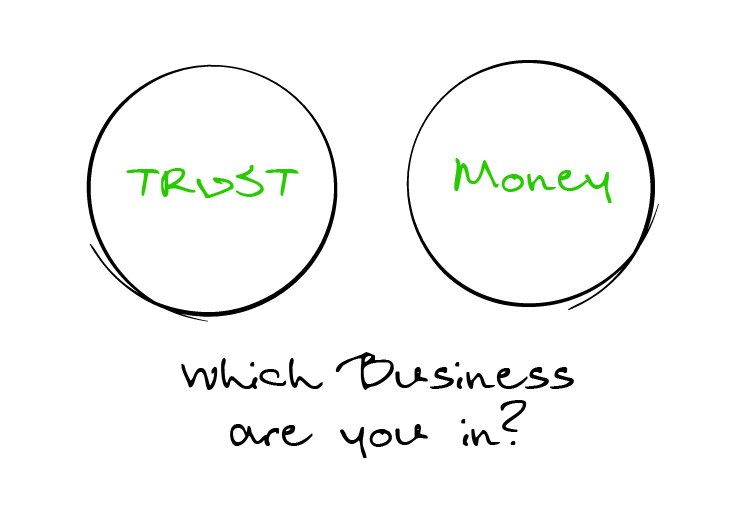

Remember we are in the TRUST Business and Not in the MONEY Business.

Think about this for a minute. When you think of your firm this way, you will make choices around your clients and not around products.

I will also be announcing monthly group discussions or workshops for those of you who are interested in learning more about this. We have conducted many such workshops and have received amazing feedback from attendees. Alternatively, you can connect with my colleagues for dates for a 1-hour session on this topic.

I hope you loved this post. Feel free to share it with your fellow IFA colleagues and friends.

My objective here is to add real value to as many IFAs as possible and help you build the wealth management firm of the future. Let me know your thoughts and if there any topics that you would like me to cover.

Similar Post

Growth

Unlocking the Metrics of Success

Let me ask you a simple question – What are the metrics of success in our industry/profession?

Just answer this instinctively.

The most common answer – Assets Under Manag ....

Read More

30 January, 2024 | 7 Minute Read

Growth

The Next Smallest Action

I had thought of writing an interesting post (this week) with the headline “Are you TAMPing it?” As I started writing this, I felt that I had left a few thoughts incomplete in ....

Read More

13 September, 2022 | 5 Minute Read

Growth

Let us WOOP it NOW.

I had written a post about WOOP on October 27th, 2020. In case you have not read it or cannot recollect it, I would strongly urge you to read it now. WOOP is simply one of the most ....

Read More

27 April, 2021 | 6 Minute Read

Growth

Making the Unknowns Known

Authors Panos A Panay and R Michael Hendrix in their book “Two Steps Ahead” wrote some interesting lines about collaboration. They start with a question - Have you ever found y ....

Read More

31 May, 2022 | 5 Minute Read

Growth

The Power of Practice (Mastering One Thing)

A few weeks back, I watched a basketball match between Boston Celtics and Brooklyn Nets at TD Garden, Boston.

While the match was super interesting, during the breaks there were ....

Read More

7 December, 2021 | 6 Minute Read

Growth

The CGCSE Board

Does CGCSE remind you of something? There is a clue included in the headline itself. Chances are you came up with the right answer (Sahi Jawaab) - IGCSE Board of Education.

30 May, 2023 | 6 Minute Read

- 8

- 2

0 Comments