From Blind Spots to Bright Spots

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

July 16, 2024 | 5 Minute Read

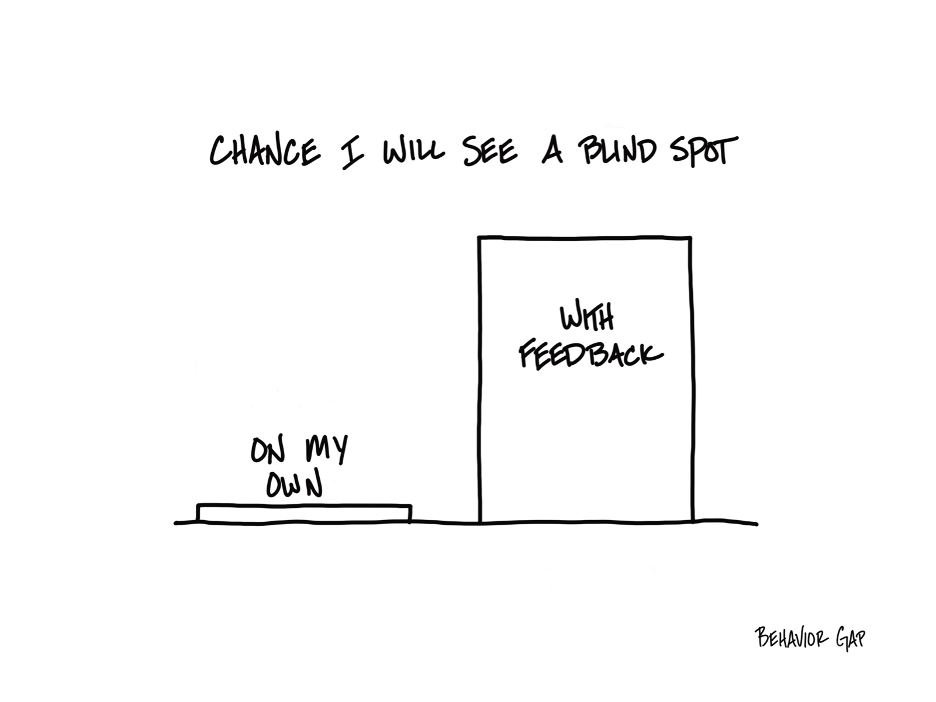

We all have blind spots, and the bitter truth is, you can’t see your own. I can’t see my own…And you can’t see yours…

Let me give you an example.

One time, I was having a conversation with a fellow financial professional. Let’s call him Girish. Girish is a highly experienced financial professional who really knew his way around the financial world. If anyone knew how to guide clients, it was him. But he was looking for help managing his own practice. I asked him, “Girish, of all the professionals I know, you’re in the best position to deal with your own practice.

Why do you need help?”

“Amar,” he replied, “I could manage my own practice, except for the ‘I’ part.”

He recognized that when it came to his own business, he had blind spots. He understood the value of having someone else help him see the mistakes he might make.

This is an important point to understand: You don’t seek collaboration, mentorship, or consultancy because you’re inexperienced or incapable. You seek these partnerships because they are not you… and, by definition, that means they will see things about your practice that you cannot see about yourself.

And that, my friends, in and of itself, is invaluable.

Just as we tell our clients to seek our guidance to navigate their financial landscapes, we too must recognize the value of seeking external perspectives to grow and enhance our own practices/business. Whether it’s through consulting with industry experts, or engaging with a world-class platform, these external viewpoints can provide insights and strategies that we might overlook because of our inherent blind spots.

By embracing collaboration, we not only improve our own business but also set a powerful example for our clients, demonstrating the importance of continuous learning and growth. In doing so, we can better serve our clients, grow our practices (make them super valuable), and ultimately, achieve greater satisfaction and success in our professional journeys.

In last week’s post, I wrote about Ram…Despite the clear benefits, many professionals, like Ram, are hesitant to collaborate. This hesitation often stems from misconceptions about collaboration, fear of losing control, and concerns about costs. Let’s address these concerns and highlight why collaboration is not just beneficial but necessary.

Misconception 1: Collaboration Means Losing Control

One of the biggest misconceptions is that collaboration means losing control over the business. In reality, collaboration is about leveraging external expertise, skills, people, and resources to enhance your business, not relinquishing control. By choosing the right partners and setting clear terms, you can maintain control over your core business while benefiting from collaboration.

For instance, when you collaborate with world class people, you are not handing over your client relationships or business operations. Instead, you are integrating advanced tools and systems that can streamline your processes, deepen client engagement (as well as the role you play in your client’s life), and provide better insights into your clients’ needs. This allows you to focus more on strategic decision-making and client-facing activities, thereby enhancing your overall service without losing control.

Here is an email of a real financial professional (from Bengaluru) on the power of collaboration. This email is presented as is. Read the lines in bold…

“Dear Amar Ji,

My hearty congratulations to you, your team and the organization !!!

I found the event 11th-13th July was very memorable, enjoyable although the agenda was so simple but simple is not easy!

The efforts of Happyness Factory are very consistent with out of the box thinking innovations, which makes everyone associated with HF feel inspired, proud and motivated.

The adages like ‘old habits die hard’, ‘elephant can’t dance’ should be forgotten by all your partners, because there is no scope to remember with your association.

Every moment I feel truly blessed and proud because of having associated with you and your team, which enabled me to serve my clients to such a higher level which I never dreamt of.

My reflection of my happiness is due to my client’s reaction !!! I aspire and believe this will be eternal.

My special thanks to PLN sir and Tech Team, their contributions are truly amazing !

I will take every cue from HF, assure my best efforts to innovate myself and constantly improve to live HappyRich !!!

My special best wishes to you and your family ”

Misconception 2: Collaboration Is Expensive

Another common concern is the cost of collaboration. While there are costs associated with partnerships, the return on investment can be substantial. Collaboration can give you instant scale and the access to world class people, client experience and many other things without any fixed cost. Additionally, beyond higher wallet share from existing clients, the enhanced value proposition can attract more clients and drive revenue growth.

Consider the example of shared technology platforms. Investing in individual software licenses and maintaining them can be costly and time-consuming. However, by partnering with a platform that offers integrated solutions, you can access cutting-edge technology at a fraction of the cost. This not only saves money but also ensures that you are always using the latest tools and features to serve your clients better.

Misconception 3: We Can Do It All In-House

Many believe they can develop all necessary capabilities in-house. However, this approach can be time-consuming, costly, and inefficient. Collaboration allows you to focus on your strengths and core competencies while leveraging partners for specialized services. This approach is more efficient and effective, not only for smaller firms with limited resources but even for the largest of firms.

For example, regulatory compliance is a critical aspect of financial services that requires specialized knowledge and constant updating to stay abreast of changes. By collaborating with compliance experts or platforms, you can ensure that they meet all regulatory requirements without diverting attention from your core activities. This not only enhances compliance but also frees up time to focus on growing the business.

Misconception 4: Collaboration Dilutes Brand Identity

Some professionals worry that collaborating with external partners might dilute their brand identity. In reality, collaboration can strengthen your brand by enhancing your service offerings and demonstrating your commitment to excellence. Clients appreciate and value financial professionals who are willing to leverage the best available resources to serve their needs.

By choosing partners who align with your values and standards, you can ensure that your brand remains strong and consistent. Collaboration should be seen as a way to augment your capabilities and provide more value to your clients, not as a threat to your brand.

Misconception 5: Clients Will Not Appreciate Collaboration

Another misconception is that clients may not appreciate or understand the need for collaboration. However, transparency is key. When clients understand that collaboration allows you to provide better services and more comprehensive guidance, they are more likely to value and trust your approach.

Explain to your clients how collaboration enhances their experience—whether it’s through faster responses, more accurate information, or access to a broader range of services. Highlight the benefits they receive from your partnerships, such as advanced technology, specialized expertise, and improved service quality.

For real financial professionals, embracing collaboration can provide access to advanced technology, specialized expertise (and skills), and amazing people. By leveraging these benefits, you can enhance your value proposition, delight existing clients, attract more ideal clients, and build a business that your clients love.

As I mentioned last week, in the US, the largest firms managing billions of dollars understand the power of collaboration. They leverage partnerships to stay ahead of the curve, despite having solid teams and resources. For smaller firms, collaboration is not just an option; it is a necessity to compete and thrive in an increasingly competitive market.

Collaboration allows you to turn blind spots into bright spots. You gain insights that can transform your practice, deepen client relationships, and drive sustainable organic growth. So, the question is not whether to collaborate, but how to do it effectively. By taking a strategic approach to collaboration, you can unlock new opportunities, drive growth, and watch your business flourish as you uncover the bright spots that lead to lasting success.

Similar Post

Growth

Bust your E-Myth

There is a wonderful quote by computer scientist Alan Kay (on the value of looking at old things in a new way) - “A change in perspective is worth 80 IQ points.”

Well, I don� ....

Read More

28 June, 2022 | 5 Minute Read

Growth

Your Legacy

When I think of legacy, I am always reminded of Steve Saint’s quote – “Your story is the greatest legacy that you will leave to your friends. It’s the longest lasting legac ....

Read More

26 October, 2021 | 6 Minute Read

Growth

The Future is What you Make of It

I launched this blog for you on January 3rd, 2020, and what a ride it has been since then. More than 2500+ of you are reading the blog on a regular basis and many are sharing their ....

Read More

4 January, 2022 | 7 Minute Read

Growth

The $10,000 Per Hour Work

This post was actually supposed to be a part of my book “The HappyRich Advisor”, but during the editing stage, I decided to reserve this one for later. The concept for the $10, ....

Read More

10 May, 2022 | 5 Minute Read

Growth

Mutual Fund Distributors vs. Sub-Brokers

“Do I have to be your sub-broker?” asked Rajendra (a senior mutual fund distributor from Mumbai). I wasn’t surprised by this question as it is a very common question that me ....

Read More

19 December, 2023 | 5 Minute Read

Growth

The New Day Resolutions

Have you heard the headline before?

I bet not.

While we have all heard and set New Year Resolutions, this one might seem new.

But I am sure you are getting some ideas to where this ....

Read More

10 January, 2023 | 5 Minute Read

- 0

- 0

0 Comments