ChatGPT, Humans, and Money

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

February 21, 2023 | 7 Minute Read

ChatGPT clears the United States Medical Licensing Examination, read a headline. ChatGPT cleared the United States Law School Exam, read another headline in a financial daily. Not to be left behind on business matters, the chatbot also cleared Wharton’s MBA exam. If ChatGPT has managed to clear all these examinations, will it be difficult for it to clear the securities examinations?

We all know the answer. Don’t we? Are you now wondering if this animal is going to replace me? Because there is a lot of online chatter about ChatGPT replacing professionals in many industries/professions.

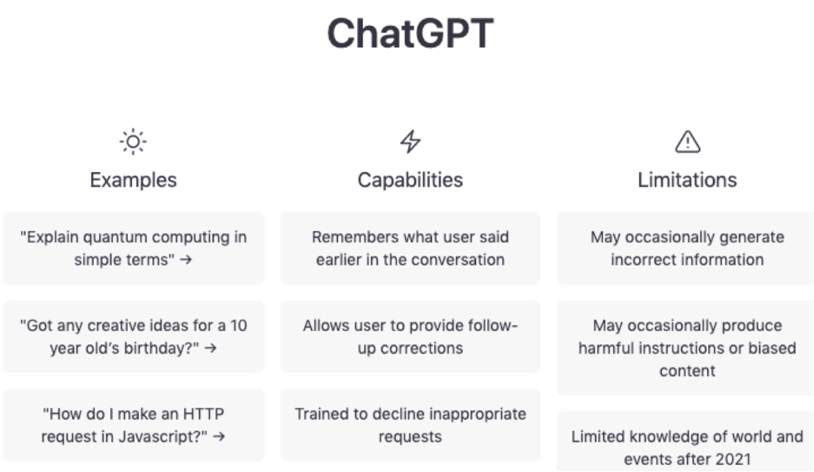

Before I answer this question, let me address what ChatGPT actually is.

ChatGPT is an Artificial Intelligence language model, developed by Sam Altman’s Open AI. ChatGPT is capable of generating human-like text based on the input (so garbage in garbage out) it is given. In five days after it’s unveiling in November, ChatGPT drew 1 million users, making this the fastest consumer product launch in history.

“I have heard of GPS but what the hell is GPT,” I hear many of you say. In case you didn’t know, I can read minds too 😊.

GPT means Generative Pre-Trained Transformer. The model is trained (by humans) on a large corpus of text data and can generate responses to questions, summarize long texts and much more. Here is a key thing to understand about this technology though.

On its own, it has no knowledge (forget wisdom) of anything. You might be surprised to know that it gets basic mathematic questions wrong (shocking for an algorithm right- but ChatGPT acknowledges this as one of its limitations).

If ChatGPT has no knowledge of its own, how does it then clear these exams?

Once you enter a question in ChatGPT, it scans the entire internet and analyzes as much publicly available text as possible. Then there is a process of making sense of stuff and properly formulating sentences. Explaining this process is the subject matter of a technical post (may be some other day especially for the tech nerds). Let’s get back to our initial question – Will ChatGPT replace financial advisors?

Rather than answering this question, I asked this question to ChatGPT.

Here is what the bot wrote – “As an AI language model, I do not have the ability to replace financial advisors. While I can provide general financial information and insights based on data and research, financial advice requires a personalized approach that takes into account an individual’s unique financial situation, goals, and risk tolerance. Financial advisors are trained professionals who have the expertise and experience to provide personalized advice that can help clients navigate complex financial situations and make informed decisions.

Moreover, financial advisors also offer emotional support and guidance in addition to financial advice, which is something that AI language models like myself are not capable of providing. While AI can assist financial advisors in their work by providing data-driven insights and automating certain tasks, the role of a financial advisor is unlikely to be fully replaced by AI in the foreseeable future.”

I pushed the bot again to regenerate a response.

Here goes the second response – As an AI language model, I am designed to provide general information and guidance based on the data and patterns in the input provided to me. However, I cannot replace the personalized and tailored advice that financial advisors provide to their clients.

Financial advisors bring a unique set of skills and expertise that is difficult for an AI language model to replicate, such as understanding their client’s specific financial goals, risk tolerance, and personal circumstances. They can also provide emotional support, education, and accountability that can be challenging to achieve with an AI-based solution.

That being said, AI and technology can complement the work of financial advisors by providing tools to help them analyse data, automate certain tasks, and make more informed recommendations to their clients. This can help advisors deliver more efficient and effective services while freeing up time to focus on higher-value activities, such as building relationships with clients and providing personalized advice.

In conclusion, while AI can be a valuable tool for financial advisors, it is unlikely to replace the need for human expertise, empathy, and personalized advice in the foreseeable future.

Contrary to what the fear mongers say, ChatGPT itself wrote that it can’t replace financial advisors. Instead, it (and yours truly too) strongly believes that ChatGPT can be a great complement for financial professionals. But a word of caution – ChatGPT is still a working model. There are a lot of errors in responses. And because of its conversational ability it might give you the perception that ChatGPT understands things. Even if it makes a mistake, you will still continue to believe that the responses provided are accurate. More importantly there is no reference point to check if there has been a mistake made. So, you have to be super cautious when you use it, as the financial services space is a highly regulated industry.

With that said, how can financial advisors work with ChatGPT?

Here’s ChatGPT’s response – Financial advisors can work with ChatGPT in several ways to enhance their services and provide more value to their clients:

• Research and Analysis: Financial advisors can use ChatGPT to access vast amounts of financial data and market trends quickly. They can also use it to conduct research on specific financial products, investment strategies, and economic indicators to inform their advice to clients.

• Client Communication: Financial advisors can use ChatGPT to communicate with their clients more efficiently and effectively. For example, they can create a chatbot powered by ChatGPT to answer common client questions, schedule appointments, and provide basic financial education.

• Portfolio Management: Financial advisors can use ChatGPT to monitor and analyze their clients’ portfolios, identify potential risks and opportunities, and adjust their investment strategies accordingly.

• Personalized Recommendations: Financial advisors can use ChatGPT to provide more personalized recommendations to their clients. They can input data about a client’s financial goals, risk tolerance, and investment preferences into ChatGPT, which can then generate investment recommendations based on the data.

Overall, financial advisors can leverage the power of ChatGPT to streamline their operations, deliver more personalized advice, and provide a better client experience. However, it’s important to note that ChatGPT is not a substitute for human expertise and judgment, and financial advisors should always use their professional judgment when making recommendations to clients.

If you see in every response, ChatGPT acknowledges that it does not have the capability or that it cannot give personalized advice.

The key thing to understand about this profession is “Personal Finance is more about Personal than it is about Finance or about Technology (whether AI or any other thing).”

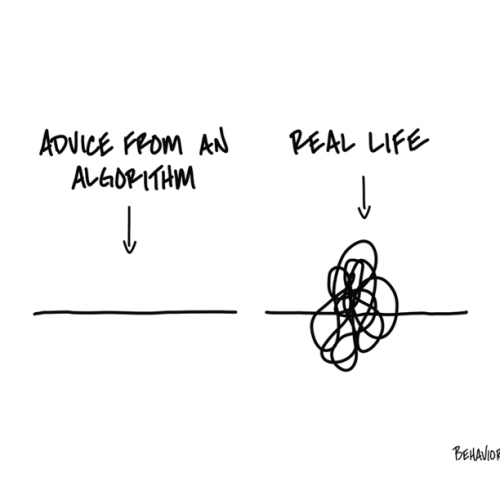

ChatGPT or no algorithm in this world can ever know what’s important to your clients about money. Forget machines, most human professionals also don’t know what’s important to their clients about money. The machine does not know your client’s dreams and goals (well you can input these). It won’t either know how your client will behave (many times we don’t know either). ChatGPT does not know how your client reacts in bad markets or euphoric markets. It does not know your client’s or your feelings about money. And as we all know by now, Money = Feelings.

Thus, Humans don’t (and won’t ever) fit into an algorithm. This is particularly true when we are talking about humans and their money. As much as we would all love a simple formula to tell us what to do with our money, the more we try to fit the big money questions into a neat little box, the more we find ourselves saying “it depends.” Because “Humans + Money” will always be a messy little cocktail.

Similar Post

Technology

The Ultimate Use of Tech

Do you know about the first movie screening in history?

It’s very fascinating. Before getting into the details, let me ask you another question.

Do you know how long this sc ....

Read More

11 October, 2022 | 6 Minute Read

Technology

The Missile Test: Choosing Platforms That Fire Up, Not Fizzle Out

Imagine you are asked to evaluate three missiles and choose the best. One is powerful and world-class, the second is mediocre, and the third is garbage. However, the salespeople fr ....

Read More

19 March, 2024 | 7 Minute Read

Technology

Cultivate This Superpower

In their book, "Why business people speak like idiots", Authors Brian Fugere, Chelsea Hardaway, and Jon Warshawsky shared a transcript, “

June 17,2003

CNN Moneyline with Lou D ....

Read More

3 June, 2025 | 7 Minute Read

Technology

The Caveman and THOG

I might not be able to find better words for the feelings and thoughts that are going through my mind now. I was thinking about a way to communicate this concept and I stumbled upo ....

Read More

28 September, 2021 | 5 Minute Read

Technology

First-Rate Intelligence

Have you heard the Aesop’s fable (story) of the father, son and their donkey? If not, here it goes.

9 August, 2022 | 5 Minute Read

- 1

- 4

0 Comments