Are you an Excellent Advisor or an Excellent Business Owner /CEO?

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

January 3, 2020 | 4 Minute Read

Socrates said, “Knowing yourself is the beginning of All Wisdom”. This is such a deep quote as understanding this will enable you to transform yourself and build the wealth management firm of the future.

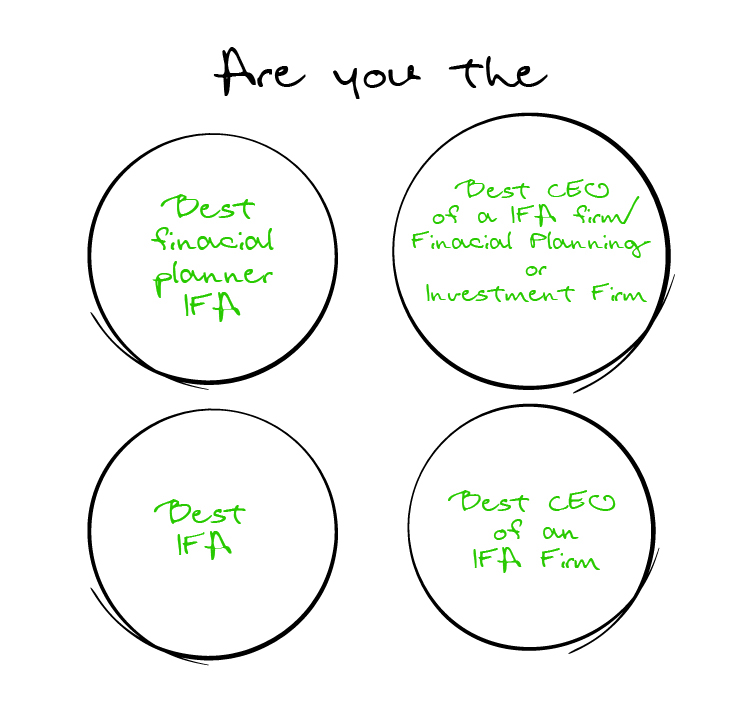

There is one sketch that I want you to think about even after you finish this post.

First, understand that these two are different roles and both require different capabilities and skills. Second, think about “Who am I? An Excellent Advisor or An Excellent CEO or both.”

Some are excellent advisors and there might be some excellent CEOs but very rarely have I come across people who are both. It’s not that you cannot be both, you certainly can but it takes a lot of hard work (Yes we all know smart work but hard work is an important foundational ingredient), commitment and perseverance to become both. Let’s take a look at what each means.

Who is an excellent Advisor?

An excellent advisor is someone who is helping clients live their happiest financial life. He is taking care of their money just like he would take care of his parents /best friend’s money, guides them through the ups and downs of life (and markets), is a coach to them, protects them from costly financial mistakes, ensures that they are able to maintain their lifestyle no matter what and holds them accountable to the promises they have made to themselves.

An excellent advisor never makes false promises about investment returns (or guarantees returns), helps his clients understand their why (money is a means to an end) and delivers on the TRUST that clients have in him/her.

On the technical side, an excellent advisor has great conversational skills, continuously unlearns and relearns embraces change as an opportunity and upgrades his skills through professional designations such as CFA and CFP. Besides this, an excellent advisor invests in reading books, workshops that will improve his skills (Self Education), keeps a global perspective and continues to challenge himself.

Don’t mistake someone who has assets and some awards as an expert or excellent advisor. Today the industry is operating on a ‘Raise your hand and you are an expert’ way. See whether the person is investing in himself to become a better professional. See if they have committed themselves to a rigorous standard of learning. Are they investing in themselves?

An excellent CEO is someone who has a vision for his clients, his team, his firm, the profession in general and then able to translate that vision into execution as given in the sketch below.

In the book, Strategy Rules, Former IBM CEO Lou Gerstner said “Vision is easy. It’s so easy to just point to the bleachers and say I am going to hit one over there. What’s hard is saying …How do I do that.”

An excellent IFA CEO must first set a Vision and then translate that Vision into a Strategy – a set of activities that the firm will do and more importantly what it will NOT DO.

I was talking to an IFA CEO who told me “I don’t know what the future of this business is.” Another one told me “It is so difficult to operate in this business anymore that I am wondering what to do.” I asked them “How much do you invest in your business?” They were not clear about the answer but I told them that this is the Best and the Worst time to be in this business. This completely depends on how you look at it but from where I am looking this is the Best time as well as the Toughest time to be in the business.

It is going to get harder and harder to operate in this business if you do not take an overall look at your business model, strategy, ideal client and value proposition. The legendary Andy Grove of Intel once said “Bad companies are destroyed by crisis. Good companies survive them. Great companies are improved by them.”

So what should you do assuming that it’s a tough but also best time to be in this business?

- Have a Positive Mindset and be open to change (This is easier said than done) but is sacrosanct.

- Understand whether your strength lies (CEO or Advisor).

- Invest first in learning to have excellent conversations. You can read books on this or practice role-plays or get a coach.

To make it easier for you, we have built a tool and program that enables IFAs to have meaningful conversations with their clients. This can also be used to train your team.

Your success lies in your ability to have meaningful conversations with prospects, clients, team members (the industry calls employees), media and whoever you meet.

Invest in this skill and you will lay a very solid foundation to become excellent in both roles.

I hope you loved this post. Feel free to share it with your fellow IFA colleagues and friends.

My objective here is to add real value to as many IFAs as possible and help you build the wealth management firm of the future. Let me know your thoughts and if there any topics that you would like me to cover.

Similar Post

Leadership

This is the KEY activity that every IFA Leader should be doing

I was speaking with a group of IFA’s who asked me “Sir, What is that one thing that we should be doing in 2020 and beyond?”. I have reproduced my response to them below but f ....

Read More

28 January, 2020 | 7 Minute Read

Leadership

Building a Legacy: What You Should Focus On

Being the CEO of a wealth firm is no small feat. It’s not just a title; it comes with tremendous responsibility. The role of the CEO is not merely to oversee the day-to-day opera ....

Read More

19 November, 2024 | 5 Minute Read

Leadership

A Critical Thing to Learn from the recent India - Australia Test Series

What do you need to Win an International Level Team Sport?

Think about it.

The answer to this question lies in the question itself. You would have figured out the answer by ....

Read More

23 February, 2021 | 6 Minute Read

Leadership

The People Behind You

What do you think is the biggest problem of most firms in our industry/profession?

Can you take a guess at what the answer might be?

Take a shot.

I have posed this question t ....

Read More

20 December, 2022 | 5 Minute Read

Leadership

Are you a Peacetime CEO or Wartime CEO?

My colleague has been speaking to a lot of distributors and advisors the past few weeks. The common thread in most of these conversations was a general sense of negativity and fear ....

Read More

7 April, 2020 | 5 Minute Read

- 0

- 1

0 Comments