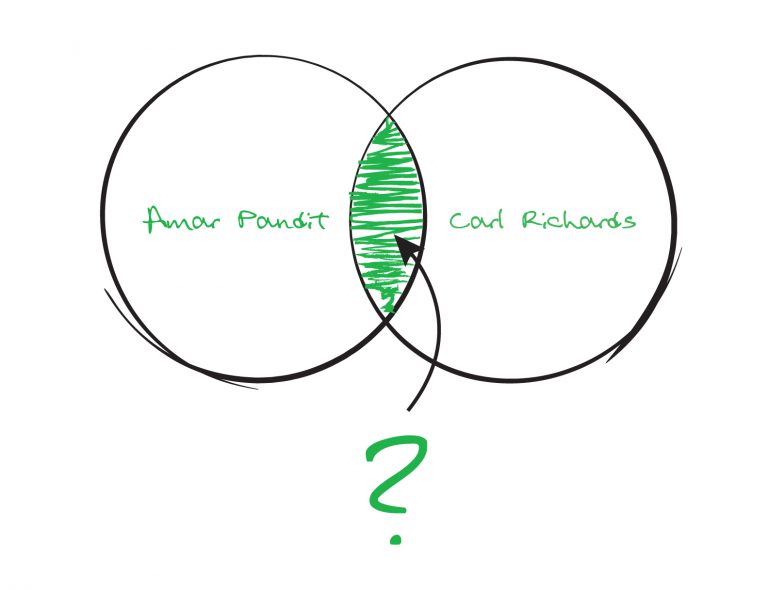

Amar Pandit + Carl Richards =?

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

July 28, 2020 | 3 Minute Read

Carl and I are super excited to announce the awesome work that we are doing for all of you. Yes, we have come together to help each, and every IFA build the firm of your dreams.

Let me tell you our little journey together. I first met Carl 10 years ago in San Diego at a conference in the US. I instantly loved his work on Behaviour Gap and the simplicity with which he was explaining complex concepts. Most importantly, they were insightful. On the other hand, I was doing my bit in terms of simplifying the complex and bringing out the real value of the financial planning process. Thus, we connected and kept in touch with each other.

Over the years, we kept bumping into each other. Carl’s work continued to gain global fame, while we had done some amazing work in the financial planning /wealth management space here (with exciting projects in FinTech, AI, Financial Life Coaching, Financial Experiences, Documentation and others). In 2016, we both got together to lay the foundation of the work that we both believed would make an awesome difference in the lives of IFAs. However, before we could nail down the details, Carl moved to New Zealand.

Finally, in 2017, Carl made a big trip to India where he spoke and presented to countless IFAs. He met me and saw the work we were doing at Happyness Factory. He told me “I have been to the Betterment office in New York and seen the work they have done, and I see what you have done. You have captured the essence of financial planning. This is simply brilliant.“

Our friendship and mutual interest in helping IFAs rekindled, and we began to make a plan to take our discussions to the next level.

We have been working on many interesting things that we will be announcing in the weeks ahead. We are both confident that you will not only love what we have in store for you, but you will derive massive value from this body of work.

Stay Tuned for more details.

P.S. Let me know if you like to be the first to know more about this.

Similar Post

Featured

Your 2026 Plan Must Begin With This

Imagine this.

You are sitting with a client.

You notice a substantial asset on his personal balance sheet.

You ask about it and he says, almost casually, “I do not know the value ....

Read More

6 January, 2026 | 8 Minute Read

Featured

The Trust Currency: Mastering the Art

A few weeks ago, I announced one of my challenging projects for the year – my 7th book, "The Philosophy of Money." While I am diligently working on it (it’s not an easy one...n ....

Read More

16 January, 2024 | 5 Minute Read

Featured

Where Do You Deliver Value?

Inspired by Bain & Company’s Elements of Value, Fidelity in 2017 introduced the Advice Value Stack to help wealth firms maximize the value they deliver to clients—and grow thei ....

Read More

7 January, 2025 | 5 Minute Read

Featured

Right Over Lucrative

Imagine this scene – You visit a world class surgeon, Dr. R Bhattacharya (name changed). Instead of telling him what your problem is or allowing him to ask you questions and begi ....

Read More

28 March, 2023 | 5 Minute Read

Featured

Book Launch of "The HappyRich Advisor"

What a year 2020 has been? It has been a year of shock, fear, sorrow, surprises, fights (with the virus and within ourselves), survival, revelations, awakenings and triumph (agains ....

Read More

29 December, 2020 | 6 Minute Read

Featured

The True Test of a First Meeting

Ashish, a mutual fund distributor from Kolkata, shared an experience with me recently.

"I met a doctor who had the CNBC app open on one hand while talking to me," he said. "The doc ....

Read More

6 May, 2025 | 7 Minute Read

- 1

- 0

2 Comments