What Really Matters When Selling Your Business

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

October 17, 2023 | 6 Minute Read

While today’s post is not exactly Part II of last Tuesday’s post (Valuation, Sale and Succession Planning – The Right Timing Dilemma), there is an important overlap…One that is always talked about but at the same time it’s one of the least understood…Let me offer a clue through a question:

What is the second important thing that gets the most attention when it comes to a sale of a practice/business?

What do you normally hear or read when it comes to a sale or M&A transaction in our industry?

If you have started thinking by now, let me guess what you are thinking and give you another clue… Are you probably thinking first about the first important thing before you attack the second one? And chances are you might have correctly guessed the first one…It’s valuation or how much the firm was sold for…Am I right? Therefore, the second important thing cannot be valuation or the value of the firm…I guess I have given some very strong clues…Haven’t I?

Many (if not all) of you might have even guessed that the second important thing that gets the most attention is the multiple…What multiple did this firm get? And for most solo practitioners or even a two-partner firm, the most common metric that is discussed is the Revenue Multiple or Recurring Revenue Multiple (RRM). There are other variations of multiples such as EBITDA Multiples, Net Profit (or Cash Flow) Multiples, and the more common PE Ratio that is generally used to value publicly listed companies… However, recurring revenue multiples get a lot of attention in our industry (even globally). Why may you be wondering?

One reason is that sellers almost always rely on a rule of thumb based on a multiple they read in some trade press or heard in a study group/WhatsApp group/ industry convention. A special point to note is that a rule of thumb always relies on the past and not the future…Confused? Allow me to explain what I mean…

In simple words the rule of thumb (when it comes to multiples) implies that the business will continue to operate at least at the same performance level it has before. A key point to understand here is that value is always a function of the future, not of the past…But a reliable way to look at the future is to also look at what has happened in the near past, the last three to five years.

When one thinks about a revenue multiple, essentially one is valuing the business based on what it has done in the past rather than on what it is likely to do in the future. Most firm owners (prospective sellers) don’t really think of this point, but most sophisticated buyers understand this very well. Thus, they look at hundreds of variables across client demographics, client service model, value proposition, internal team/leadership, risks, firm’s growth engine, systems and processes, client acquisition capabilities, competition, cost structures necessary to take care of existing clients, and so on.

Prospective sellers rely on this rule of thumb as that’s the only data easily available about private market transactions. However, most firms have an earn-out or performance contract-built in…so the real value is never known until the earn-out phase is over…but more on this in another post explaining earn-outs and deal structures.

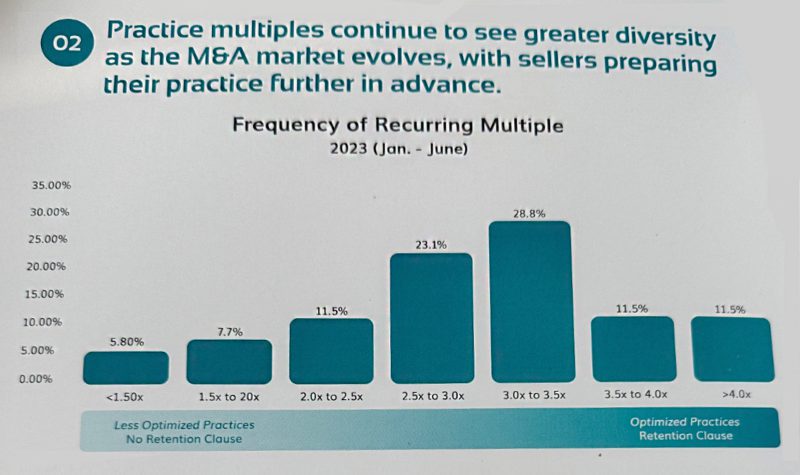

I now share an interesting visual I received from my colleague about some data shared by an RIA M&A Consulting Group in the US…Since I don’t have the source of this visual available, I am unable to attribute this to the right source…

What comes to your mind as you look at the above data?

An important observation is about the huge spread among the multiples received by firms. Almost 80% of the firms have received between less than 1.5X to 3.5X of recurring revenue multiple. The average recurring multiple across all the firms in the above chart is around 3.3X recurring revenue multiple. Around 11.5% of the firms have made it above the 4X recurring revenue multiple. These spreads are likely to be similar if not more in our MFD and RIA industry too. Additionally, the multiples are likely to be lower based on the number and type of clients that firms have in India. In most US RIA firms, the typical client is an affluent person or a high net-worth one. Thus, the assets under management overall and the recurring revenue per client is likely to be higher.

In the Indian context though, a substantial number of clients come with lower minimums and lower recurring revenue per client. Besides this, the number of clients is likely to be far more than what one would see in a typical US firm. The reality of our industry (in US and India) though is that most firms have a substantial book of business from clients who are not really a part of their ideal client profile anymore, but they are still obligated to serve them. Another reality of our industry is that the less dependent the business is on you, the more valuable it is (again a simple point that many don’t understand). And the time to make the business less dependent on you is not when you are thinking of a sale/succession.

In all this chatter about recurring revenue multiples, one of the things that’s often missed is the hard work owners need to do to get their businesses ready for sale, succession, retirement, or transition. As a firm owner, you must ensure that there is a team that has the necessary skills, and motivation to take on client responsibility, business development and business management. You need to also ensure that the buyer has the ability and desire to take care of your clients and team.

Instead of obsessing about these multiples, you need to figure out the following about the prospective buyers- the kind of firm they have built…the kind of culture they have created…the kind of people they have hired…their drive for excellence…how they do business …how they treat, support, and care for you…how they take care of their clients and team members…Figure out what the current firms who have joined them speak about them… This takes some proactive work and commitment from your end…For some, these steps seem boring or hard…They just want a quick fix… And in this process, firm owners end up missing the opportunity to build a world class firm.

Another important thing that is often missed out is the point that you need to create a business that someone would want to buy even if you are not ready to sell or transition now…This is about creating a sale ready business…a business that is attractive for not just prospective buyers but for your clients, family, team and the industry in general…It simply gives you more options and the opportunity to leave behind an amazing enduring firm…

The question is – Are you ready to build a sale ready business?

Similar Post

Succession Planning

Building Value in your Firm

I ended my previous post on “Succession Planning and M&A Simplified” with the following paragraph:

“Most people are looking at some AMC valuation metrics and coming to conclu ....

Read More

1 June, 2021 | 8 Minute Read

Succession Planning

Understanding Sale, Succession, and Continuity Planning

Uday, a mutual fund distributor and a long-time reader wrote - "Can you please write a post explaining sale planning, succession planning and continuity planning? I don't think I h ....

Read More

11 June, 2024 | 5 Minute Read

Succession Planning

This Is Not Succession Planning

Ajay, an MFD from Karnataka, proudly shared, “I think my succession planning is done. My daughter is joining the business.”

A statement like this often sounds comforting, even ....

Read More

11 February, 2025 | 5 Minute Read

Succession Planning

Knife in a Gun Fight

I know this headline might seem odd, but I couldn’t think of a better one for today’s post. By the way, this post is not about a gun fight nor is it about a physical fight eith ....

Read More

28 November, 2023 | 5 Minute Read

Succession Planning

Building Value in your Firm

I ended my previous post on “Succession Planning and M&A Simplified” with the following paragraph:

“Most people are looking at some AMC valuation metrics and coming to conclu ....

Read More

1 June, 2021 | 8 Minute Read

Succession Planning

Who will win Wealth Management?

The recent Bain & Company Wealth Management Report projects a $90 trillion increase in assets from all investors globally by 2030. Bain also projects digital human hybrid firms win ....

Read More

19 July, 2022 | 5 Minute Read

- 1

- 0

0 Comments