What Do You Mean by “Good”?

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

October 29, 2024 | 5 Minute Read

“My advisor gave me good returns,” Jo, a prospective client in her sixties said. But what does “good” really mean? This is a question every financial professional should be asking their clients. Because, while “good returns” might sound positive, it’s often vague and open to interpretation. What one client considers good might fall short for another, and without clear definitions, expectations and satisfaction levels can become misaligned.

Defining “Good” Is Essential

As a real financial professional, you know that investing is not a one-size-fits-all journey. Yet, many clients have only a surface-level understanding of what “good” means in the context of returns. For some, it might mean outperforming the market. For others, it could be steady growth with low volatility. Some might want returns that allow them to comfortably retire, while others seek wealth accumulation for future generations.

It’s your role to dive deeper and ask: What does “good” look like for you? It’s about translating this vague idea into something concrete and measurable. By doing so, you align your strategies with their values and expectations.

The Importance of Setting Benchmarks

One of the first steps in clarifying what “good returns” means is to establish benchmarks. Some clients might say, beating the market is their goal. If you hear this, ask why it is important.

This is because we are really bad at knowing what we actually want.

In fact, we learn what we want by watching other people. First, by seeing what our parents, siblings, and peers want, followed, eventually, by what people on social media want.

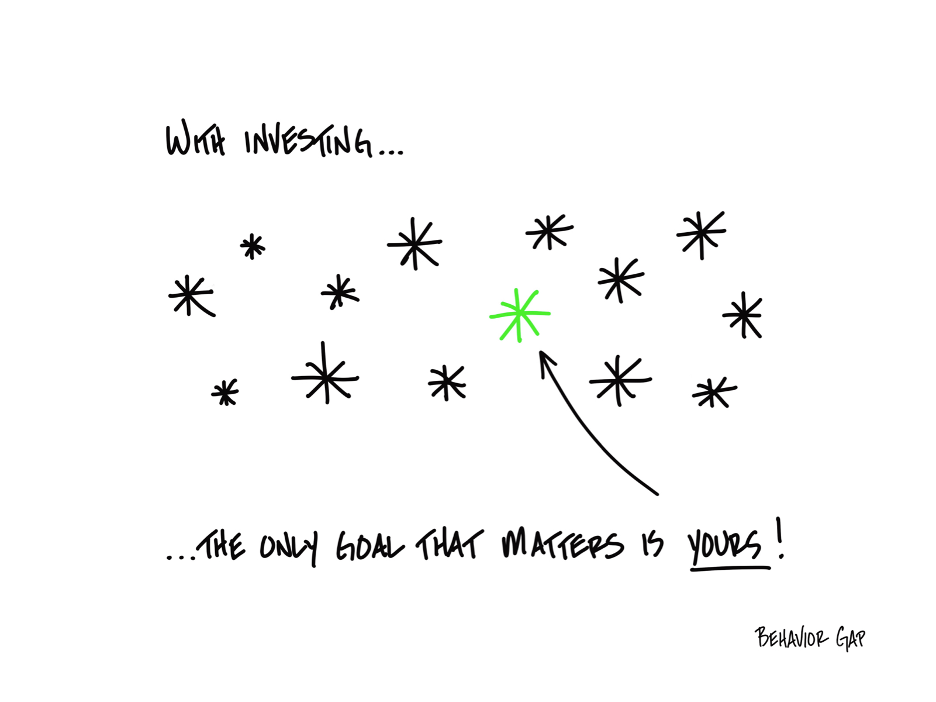

We co-opt other people’s goals because it’s very hard to get clear about our own goals.

You know how this plays out, right?

You hear your wealthy friend talking about how important it is to beat benchmarks, so you think you should beat benchmarks, too. You hear about all the cool kids investing in startups and all the fancy people buying Teslas. Maybe you should do that too.

Here’s the thing: nothing anyone else owns, wants, or does, has anything to do with you. Because they aren’t you.

You, and only you, are you. And for that reason, the only goal that matters when it comes to your money is your own.

Therefore, it’s important to help clients figure out what their benchmark really is. Be clear whether achieving a 6% return annually will help them meet their retirement goals. These benchmarks give both you and the client a shared understanding of success.

If a client has not clearly defined what “good” means for them, it’s impossible to know if their expectations are realistic or attainable. Therefore, you should actively work to set clear, realistic benchmarks that are relevant to their unique circumstances. This not only makes your work measurable but also helps manage expectations.

Aligning “Good” with Goals

It’s crucial to connect returns to the client’s goals rather than relying on abstract numbers or market comparisons. A 7% post tax return might be “good” for one person whose primary objective is to preserve wealth, while it may fall short for someone else who needs to maintain a certain lifestyle.

Discuss your client’s goals in detail. Are they focused on long-term wealth accumulation, early retirement, funding education, or creating a legacy? Only by understanding their personal vision can you define what “good” truly means in their context.

Communicating Risk and Return

Once you’ve defined what “good” looks like, it’s equally important to discuss the risk associated with achieving those returns. Many clients focus on returns without fully understanding the risk they must take on to achieve them. A return that matches the market might be sufficient for someone who is risk-averse, while a client seeking higher-than-market returns must be comfortable with greater volatility and potential drawdowns.

Make it a point to explain the trade-offs involved. Highlight that there is no magic formula that delivers high returns without risk. There are no high returns without risk (or with low risk). If you suppress volatility (by various methods), you end up suppressing returns too. A transparent discussion about risk helps clients appreciate the journey they must take and builds trust.

Saying No When Necessary

Sometimes, clients will come to you with unrealistic expectations. They may have heard stories of others getting 20% annual returns and expect you to replicate that, without considering the associated risks. In such cases, it’s important to have the courage to say no.

As a real financial professional, you must protect the client from their own unrealistic ambitions. It’s better to set boundaries and have honest conversations upfront than to disappoint them later. If they insist on pursuing strategies that go against their risk tolerance or long-term interests, it may be time to re-evaluate the relationship. Standing firm on your expertise, even if it means challenging their expectations, is key to providing responsible, ethical guidance.

The “Good” Conversation: An Ongoing Process

Financial professionals often make the mistake of defining what “good” means at the start of the relationship and then leaving it there. I have made it too. But the market evolves, and so do client needs and life stages. A return that’s “good” for a client in their 40s might not be adequate at a certain point of time.

Make it a point to revisit these definitions regularly. Schedule reviews, discuss changes in their life situation, and adjust their benchmarks if necessary. This ensures that your relationship with the client remains relevant and that their portfolio continues to align with their evolving goals.

Demonstrating Value Beyond Returns

One of the best ways to provide clarity around “good” is to educate clients on the value you bring beyond just returns. Show them how you are working to protect their lifestyle, build multi-generational wealth, leave a legacy, manage risk, and protect their assets. Highlighting these elements positions you as a world class real financial professional.

It’s about shifting the conversation from performance to purpose. Returns are just one part of the picture. Clients must see how everything ties together: their life goals, the risks they are willing to take, and the holistic life plan you have designed for them.

The Power of Education

Educating clients about what realistic expectations look like is essential. Explain the historical context of the markets, show them the power of compounding over long periods, and emphasize the importance of sticking to a plan. When clients understand the fundamentals, they are less likely to fixate on arbitrary performance numbers or short-term fluctuations.

By equipping them with knowledge, you empower them to see the bigger picture. This also gives them the confidence to stay the course, even when returns don’t meet short-term expectations.

Have You Defined “Good” Together?

If your client simply says, “My advisor gave me good returns,” and cannot explain what that means, there’s a problem. It indicates a lack of clarity. It’s a signal that they might not have been engaged or educated properly about their goals and their portfolio.

As their real financial professional, it’s your job to fill that gap. Define what “good” means for each client, set the right expectations, and educate them along the way. Doing so not only enhances your value but builds a lasting, trusting relationship. The goal is to ensure that when they think of “good returns,” they understand the deeper meaning behind those words and feel confident that they are on the right path.

Finally, make sure your clients deeply understand these two insights –

“Good returns aren’t about beating the market or timing the market; they’re about meeting your own personal goals.”

“The only goal that truly matters in investing is the one that’s yours.”

On that note, I wish you and your family a very HappyRich Diwali…filled with loads of great health, amazing relationships, love, and peace. Happy Dhanteras ❤️

Similar Post

Leadership

The Successful IFA

Are Successful people only those who have High Networth? I am not using Highest otherwise Mukesh Ambani will be the only successful person in the country.

By the way, I totally di ....

Read More

21 July, 2020 | 5 Minute Read

Leadership

The Surest Way To Make A Great Decision

The best decisions often don’t feel comfortable.

They don’t feel obvious. They don’t feel easy.

Brian Whetten, in his book Yes Yes Hell No, explains how great decisions evoke ....

Read More

25 February, 2025 | 5 Minute Read

Leadership

The Surest Way To Make A Great Decision

The best decisions often don’t feel comfortable.

They don’t feel obvious. They don’t feel easy.

Brian Whetten, in his book Yes Yes Hell No, explains how great decisions evoke ....

Read More

25 February, 2025 | 5 Minute Read

Leadership

The Successful IFA

Are Successful people only those who have High Networth? I am not using Highest otherwise Mukesh Ambani will be the only successful person in the country.

By the way, I totally di ....

Read More

21 July, 2020 | 5 Minute Read

Leadership

Are you an Excellent Advisor or an Excellent Business Owner /CEO?

Socrates said, “Knowing yourself is the beginning of All Wisdom”. This is such a deep quote as understanding this will enable you to transform yourself and build the wealth man ....

Read More

3 January, 2020 | 4 Minute Read

- 0

- 0

0 Comments