The Stunts of New Age Competition

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

April 12, 2022 | 6 Minute Read

Last Tuesday, I wrote about a post explaining the concept of “TechFin and FinTech”. This week, I am sharing a few specific examples about the “Win at All Costs FinTech Competition” that you face. This specific type of competition does things first (and fast). They don’t bother to check with the regulators or even with their lawyers. All they care about is speed and acquiring customers at any cost. They have their venture capital masters to please with high growth and an attractive IPO. Thus, they are happy to pay fines too (in fact this is part of their business model). They know that no one is going to bar them for good. All they need to do is pay a small fine and then continue business as usual as if nothing happened.

I will start with Robinhood (the US retail trading sensation) and then move to a couple of examples in India. Bloomberg had written a post in December 2018 with a headline “Robinhood Checking Moved Fast and Broke”. According to Bloomberg, “Robinhood Financial LLC announced a new product called “Robinhood Checking & Savings,” which would allow anyone to open a deposit account with no-fee ATM access, a debit card, insurance from Securities Insurance Protection Corp (SIPC) and a 3% interest rate. Robinhood is not a bank, so it can’t issue checking and savings accounts, so it was all a bit weird.”

Matt Levine, the author of this opinion piece writes, “I assumed, perhaps foolishly, that Robinhood has some lawyers and that they had thought about this and figured out a way to do it legally. For instance, Robinhood can’t issue a checking account or a savings account, since those are things only a bank can do, but ‘checking & savings’ (read this carefully), is technically neither of those things and so perhaps it falls into a grey area. “A magic ampersand,” I called it.”

Well, there was no grey area or any area to play. Matt writes further “By Friday afternoon (the next day), the head of SIPC told reporters that SIPC would not insure the accounts and had reported Robinhood to the Securities and Exchange Commission (SEC). And by Friday evening, Robinhood Checking & Savings was no more. It is such a pure fintech story: Things broke faster than they could move! What if we just offered a checking account and paid 3%, someone presumably said, and rather than responding to that idea in the traditional financial industry way (by calling their regulator or at least checking with their lawyers), they responded in the bold new fintech way (by doing it or at least by publishing a blog post saying that they were doing it).”

What was the plot here? Attract accounts with the carrot of a higher interest rate (3% versus banks offering 0.1%)

The new FinTechs have 2 arrows up their arsenal:

- Higher returns

- Lower costs (thus apparently leading to higher returns – which is not true).

Now let’s look at some examples in India. Read the below mentioned text:

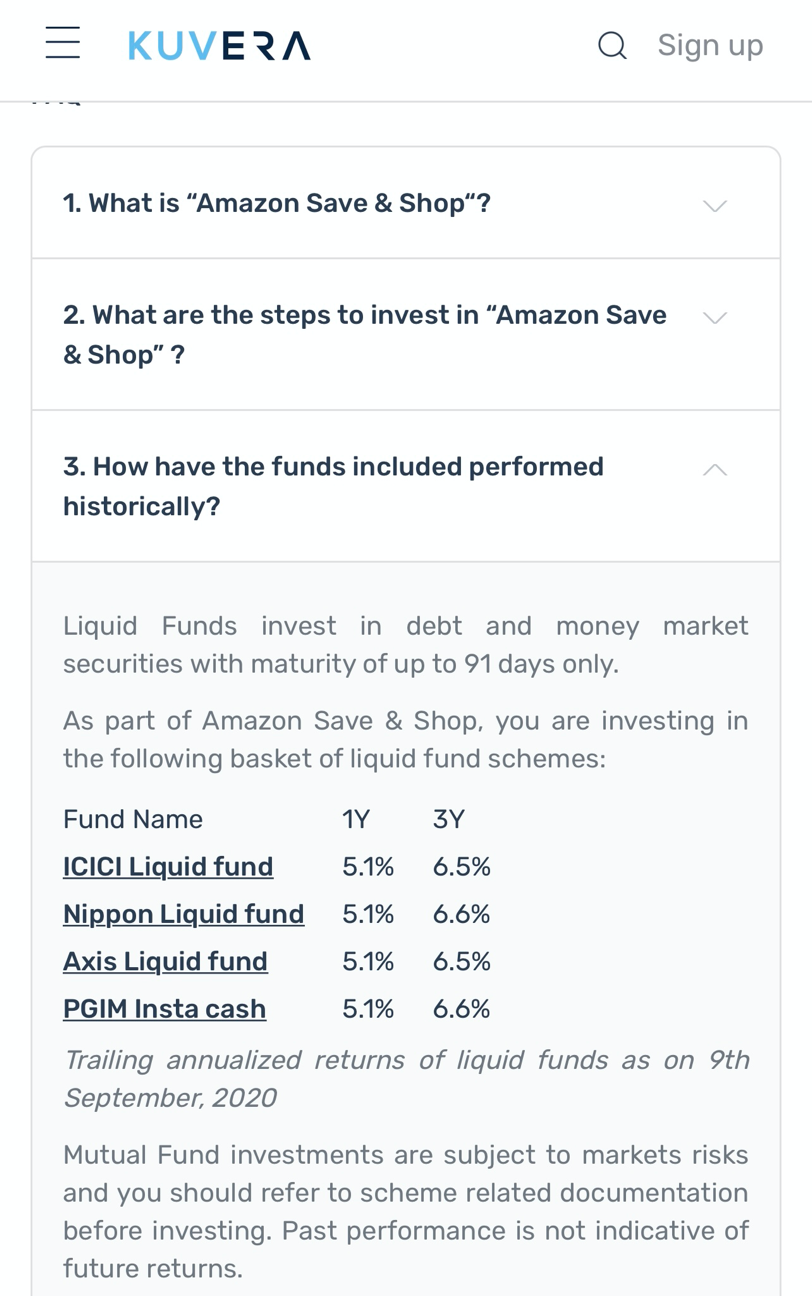

“Amazon Save & Shop” helps you save up for shopping during the festive season and get extra benefits if you decide to avail Amazon Pay gift card during the offer period. You can invest up to INR 90,000 in this fund till 20th September 2020. The amount will be invested in low-risk liquid funds. Then if you decide to redeem the funds between 1st October and 30th November 2020 and avail the option to get Amazon Pay gift card, you will receive an additional 3% top-up on your gift card amount. You can use this gift card to shop on amazon.in or wherever Amazon Pay balance is accepted for payment. For more details on Amazon Pay Gift card check here.

The above paragraph is from the Kuvera website.

When you read this, it comes across as an Amazon advertisement. Look at the dates carefully. This was much before the September 2021 announcement of Amazon’s tie up with Kuvera to offer wealth management service. Forget the line of their announcement date, but what was this offer really if not a clear rebate (whether in a clever or legal way).

The next example however takes the cake. A distributor from Ahmednagar lost 3 clients to IndWealth, a FinTech that supposedly emailed his clients with an offer to move their investments from a regular plan to a direct plan. IndWealth’s email to his clients had specific scheme names along with their folio numbers. The email was explicit in terms of how much money they will earn by going direct. He further added that IndWealth promised higher returns because of investing through them. I will be doing a detailed story on this one shortly. Keep an eye out for this one.

There are many other examples including many who have been using the Direct Plan as a way to garner quick assets from investors (using mutual funds as loss leaders).

- Do they have a superior offering? No.

- Are they delivering a superior value proposition? No.

- But are they communicating a superior value proposition? Yes, in the form of lower costs.

These lower costs seem superior in the absence of a real value proposition.

The best way to battle this is by having a world class client experience and a real value proposition of taking care of your clients better than anyone else.

The mantra here is – Compete; Don’t Complain.

The question then is “Are you Prepared?”

Similar Post

Marketing

The 2 Biggest Issues with your Key Marketing Tactic

Ask any wealth management/financial planning firm globally about their most important source of growth and you are likely to get only 1 answer – Referrals. Yes, I know there are ....

Read More

14 July, 2020 | 7 Minute Read

Marketing

This is the way to create Impact through Marketing

Seth Godin in his book “This is Marketing” writes “Marketing is the generous act of helping someone solve a problem. Their problem. It is a chance to change the culture for t ....

Read More

12 January, 2021 | 6 Minute Read

Marketing

The One Marketing Decision that will make you wildly successful

I was speaking with a group of IFAs after our 2 day BootCamp (Training Program) and one of them asked me “How much should I spend on Marketing? Where should I invest in Marketing ....

Read More

3 January, 2020 | 4 Minute Read

Marketing

The Oldest Barber Shop in the World?

Do you know the answer to the headline question?

There are chances you might not know this...I didn’t until 8 or 9 years ago...

On a sunny day in 2015, I called my hairstylist ....

Read More

5 March, 2024 | 5 Minute Read

Marketing

Your Best Marketing

“Wow, I’ve never seen this before. This is what I’ve been looking for.”

That’s what Mr. Murthy said in our first meeting.

And Mr. Sharma.

And Mrs. Iyer.

And so many other ....

Read More

15 April, 2025 | 5 Minute Read

Marketing

This is the way to create Impact through Marketing

Seth Godin in his book “This is Marketing” writes “Marketing is the generous act of helping someone solve a problem. Their problem. It is a chance to change the culture for t ....

Read More

12 January, 2021 | 6 Minute Read

- 0

- 0

0 Comments