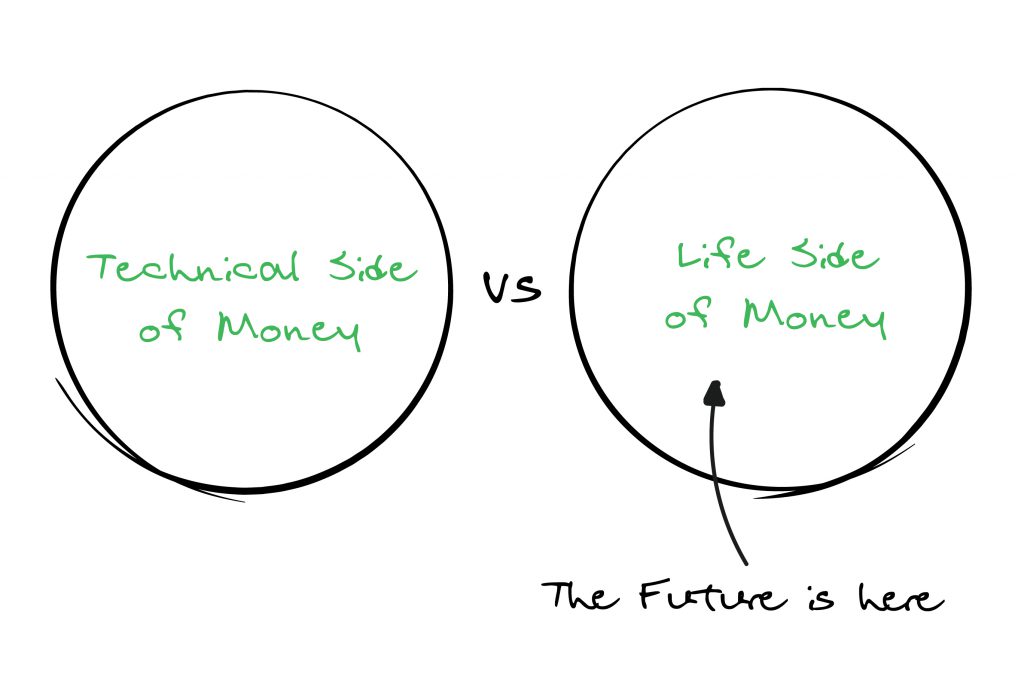

Technical Side of Money versus Life Side of Money

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

June 19, 2020 | 1 Minute Read

Most distributors and advisors obsess over the technical side of money – the products to choose, the benchmarks to beat, costs, returns, designations, better excel sheets and so on. They think that this is their differentiation and value add to a client. However, every value proposition sounds extremely similar and the client promise is setup for a failure at the outset of the client relationship. Best of all we send monthly or quarterly statements to show how this promise is not kept (because the focus is products and returns).

The Future is about Focusing on the Life Side of Money. How can you help a client live a Happier Financial Life? How are you getting clients to make progress in their financial lives?

Think about how valuable your guidance is to the client that even in COVID-19 times, he/she is able to maintain his/her lifestyle and does not have to worry about money. How valuable is your offering when it can help a family sleep well at night knowing that they are doing OK and that they are on track? There is no cost/price that you can attach to this (because it is priceless) and clients feel this when you have done this for them.

If you do this in a world class way, you do not need to show quarterly reports to justify your value.

Your role is to Answer Life’s Expensive Questions such as “How much is Enough to lead the life that I want? Do I have Enough? What do I need to do to have Enough?” (This is not an exhaustive list, but I am sure you get the drift.)

The Future is all about focusing on the Life Side of Money and the sooner you get this, the better and stronger your firm will be.

Similar Post

Nano Learning

37.8 or 0.03

Does this headline remind you of something?

Compounding is what I was trying to get at.

As you know, compounding works in both directions.

Can you guess the number of times y ....

Read More

29 April, 2022 | 2 Minute Read

Nano Learning

6 Myths that IFAs have about their value or how they need to demonstrate their value

As I had mentioned earlier this week, I am presenting the first Nano Learning for you.

It will only take 1 minute to read but you should take a few minutes or more to reflect and ....

Read More

27 January, 2020 | 2 Minute Read

Nano Learning

This Person Learns Most in The Classroom

James Clear wrote, “The person who learns the most in the classroom is the teacher. If you really want to learn a topic, then teach it. Write a book. Teach a class. Build a produ ....

Read More

19 September, 2025 | 3 Minute Read

Nano Learning

Why I Succeed?

Who do you think the “I” in the headline question is?

Well it’s not important because the answer to the question will not change.

The “I” can be anyone – you, me, or ....

Read More

4 November, 2022 | 2 Minute Read

Nano Learning

The Future Belongs to…

Estée Lauder once said, “It’s easier to get to the top than to stay there. You can have the finest product in the world, but if you don’t go to sell it, it’s worth nothing ....

Read More

5 September, 2025 | 2 Minute Read

Nano Learning

The Unexpected Key To Achieving Our Ultimate Goals

Today’s visual, shared by our partner Mr. Hemant Dighe, strikingly illustrates a compelling message: while competition often confines us within the boundaries of individual ambit ....

Read More

3 May, 2024 | 2 Minute Read

- 1

- 0

0 Comments