TAMP it!

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

March 9, 2021 | 7 Minute Read

Have you come across the acronym TAMP?

Can you take a guess about what it stands for?

TAMP stands for Turnkey Asset Management Program.

Investopedia says a turnkey asset management program offers a fee-account technology platform that allows financial advisors, broker-dealers, insurance companies, banks, law firms and CPA firms to oversee their client’s investment accounts. It further adds “Turnkey asset management programs are designed to help financial professionals save time and allow them to focus on providing clients with service in their areas of expertise, which may not include asset management tasks like investment research and portfolio allocation. In other words, TAMPs let financial professionals and firms delegate asset management and research responsibilities to another party that specializes in those areas.”

Now you might say, I do all of this and I am indeed an expert in all these areas. Let us assume that you are, ask yourself “Is this the best use of my time?” The best financial professionals in the world are outstanding allocators of Time Capital. They understand the business they are in and they focus on activities that will drive the growth of the firm. Everything else is outsourced.

You will be amazed to know that this category manages more than $600 billion dollars and it is growing. To contextualize, this is roughly 2 times of our entire asset management industry. One of the biggest TAMPs AssetMark is even listed on the NASDAQ.

So why are so many wealth firms in the US opting for TAMPs? Do they not understand what is valuable or do they truly understand what is really important for their business? I will bet on the latter that these guys really understand what their core competency is and the business they are in.

In fact, AssetMark gives the following metrics when outsourcing investment management:

- 8.4 hours saved per week

- 27% growth in AUM on average

- 68% respondents reporting that outsourcing improved their client relationships

The point of this post was not to popularize TAMPs but to make you aware of it so you can start thinking about structuring your business for scale and to thrive in the future.

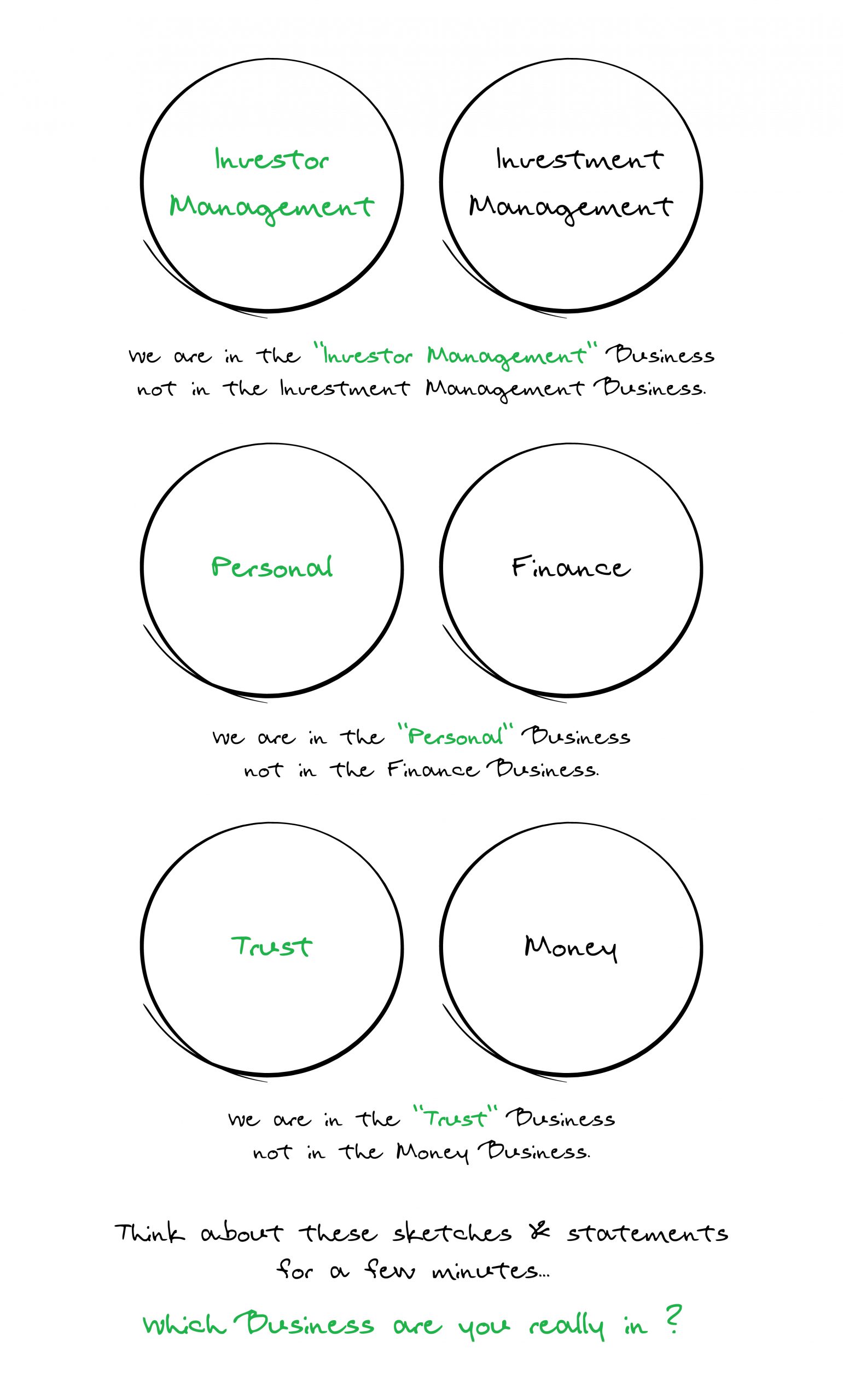

The biggest issue facing most financial professionals (even globally) is not knowing the real business they are in. This leads to suboptimal choices in organizational design, recruitment, team, value proposition, client experience, marketing, and growth. I will elaborate on what I mean by “not knowing the real business they are in” through a sketch “What Business am I Really In” from my book “The HappyRich Advisor”.

This is a self-explanatory sketch, but I would urge you to think about these lines and internalize them.

Sadly, many of us think that our job is to select mutual funds or investments. Many also feel this is the only way to demonstrate value and that they are really good in this space. I have come across very seasoned people in our industry confused on what their true value proposition is.

If you indeed are that good in asset management, a better way to invest your time would be to start your mini mutual fund or portfolio management scheme or even a newsletter reaching thousands of subscribers. Some of you may be super good and thus you should consider an alternate career by becoming a manufacturer yourself or better yet a newsletter service (with no investment other than your intellectual capability) as that would lead to an outstanding ROI for you. However, the reality is we know that asset management/portfolio management is a very specialized business and the skills required are very different than the ones required in the personal, trust and investor management business.

One of the key concepts that I had explained in one of my previous posts was the concept of Leverage. We all understand this so well. The key to successful leveraging is to understand the concept of Collaboration and Outsourcing. Even the fiercest competitors in the pharma space J&J and Merck are collaborating to increase manufacturing capacity of vaccines.

The need of the hour for everyone is to collaborate with partners who can provide you the know-how, team, support, and technology required to scale and/or outsource the functions that are taking up a lot of your time but are not providing you with any competitive advantage.

Ask yourself – Why did my client sign up with me?

Initially it was about Access or that you were local or that you were referred by someone. However, the competition today is at a very different level and revenues are constantly under pressure while costs will continue to go up. This calls for innovation in terms of your business model and value proposition.

Ask yourself some more questions.

- Do you think your client will not sign up with you because you are offering XYZ Mutual Fund versus ABC Mutual Fund?

- Do you think you can predict the performance of mutual funds? Remember that it is so difficult for asset managers to select securities in their portfolio and to construct a portfolio. How often do they go wrong? Many times. Now imagine how difficult it is to select a manager while hoping that their assets do not grow fast enough (causing them to underperform) or that they don’t bet on the wrong sectors or that they don’t do anything silly to cause loss of reputation to you.

There are professionals who have understood that the real value of their work does not lie mainly in selecting investments, but it lies in helping their clients live the lives they have imagined with their money. Thus, many have TAMPed it and it is a trend that is likely to continue.

Remember Singapore’s First Prime Minister Lee Kuan Yew’s famous quote “If you deprive yourself of Outsourcing and your competitors do not, you are putting yourself out of business.“

Similar Post

Leadership

Are You Chasing Excellence or the Spotlight?

The other day, my colleague Sayok had an interesting conversation. He spoke with a mutual fund distributor Joseph, someone who should be focused on serving clients. But the convers ....

Read More

5 November, 2024 | 5 Minute Read

Leadership

The Leadership Test

We all have limited time, attention and energy.

But at the same time, we all face two sources of pressure. The first one is the need to perform and the second one is the need to t ....

Read More

17 May, 2022 | 5 Minute Read

Leadership

3 things an IFA should not be wasting time on

I recently visited a renowned IFA (thousands of clients and ₹1000 Crore of Assets) in his Mumbai office and he told me something very interesting. “I now realize why you never ....

Read More

3 January, 2020 | 6 Minute Read

Leadership

The Leadership Test

We all have limited time, attention and energy.

But at the same time, we all face two sources of pressure. The first one is the need to perform and the second one is the need to t ....

Read More

17 May, 2022 | 5 Minute Read

Leadership

The Plumber

In case you are wondering if I have got the headline right, I assure you that I have (even though I was writing this post pretty late in the night).

Several years ago, I read an i ....

Read More

15 November, 2022 | 5 Minute Read

- 0

- 0

0 Comments