The Attention Game

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

November 7, 2025 | 2 Minute Read

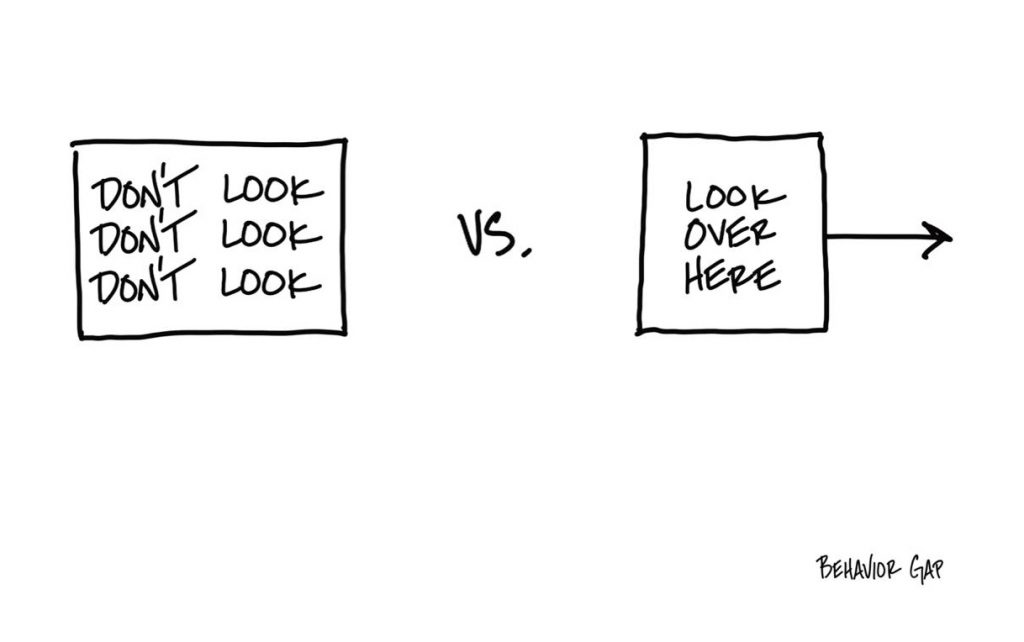

Most financial professionals tell their clients, “Don’t look at your portfolio too often.”

But have you noticed how that rarely works?

The more you tell someone not to look, the more they want to.

It’s human nature.

Tell a child not to touch the chocolate jar, and you know what happens next.

The same applies to investors.

When markets fall, the natural instinct is to look more often, not less.

The problem isn’t curiosity. It’s attention without direction.

Instead of saying, “Don’t look,” a better strategy is to say, “Look here instead.”

Shift their focus from noise to meaning.

From stock prices to goals.

From the portfolio’s value to the plan’s purpose.

When the Sensex falls, rather than asking, “How much did my portfolio drop?”, help them ask, “Has my life plan changed?”

When markets rise, instead of celebrating short-term gains, help them see, “Am I closer to my long-term goals?”

As MFDs and advisors, we are not just money managers.

We are attention managers.

Because what clients look at determines how they behave.

And how they behave determines their outcomes.

Stop telling them what not to do.

Show them what to do.

Don’t say, “Don’t panic.”

Say, “Let’s review what really matters.”

Don’t say, “Don’t look at the markets.”

Say, “Let’s look at your financial strategy.”

Investing success is not about perfect timing.

It’s about consistent focus.

And your role is to help clients direct that focus toward what they can control: their goals, savings, discipline, and time horizon.

Because in investing, as in life, attention is your greatest asset.

It’s not about don’t look.

It’s about look in the right direction.

Similar Post

Nano Learning

The Second Arrow

There is an insightful story of Buddha’s teaching in the book “Ichigo Ichie” by Hector Garcia and Francesc Miralles.

“If a person is walking through the forest and is sho ....

Read More

8 October, 2021 | 2 Minute Read

Nano Learning

The 2 Types of Clients

I came across this outstanding tweet that I am sure you will find super insightful.

This is simply spot on. A visual that explains the two types of clients extremely well.

We a ....

Read More

13 May, 2022 | 2 Minute Read

Nano Learning

The Obstacle to Overcome

Shane Parrish in his email newsletter FS wrote something very insightful.

“A huge obstacle to success is a fear of appearing foolish.

When we learn to walk, we fall over and ....

Read More

26 August, 2022 | 2 Minute Read

Nano Learning

The Explorer

An Australian Advisor said a fascinating thing.

She said “Most advisors might be good technical people, but they are not truly entrepreneurial. They are not Explorers. Their bus ....

Read More

11 June, 2021 | 2 Minute Read

Nano Learning

Which CEO Are YOU?

Many financial professionals proudly wear the CEO title. They call themselves the Chief Executive Officer of their firm. But in reality, they are the Chief Everything Officer.

20 December, 2024 | 2 Minute Read

Nano Learning

The Illiterate of the 21st Century

What do you think is the answer to the headline? Any guesses... The Late Alvin Toffler (Futurist and Writer) wrote the perfect answer

28 June, 2024 | 2 Minute Read

- 0

- 0

0 Comments