Collect or Connect Dots

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

April 5, 2024 | 2 Minute Read

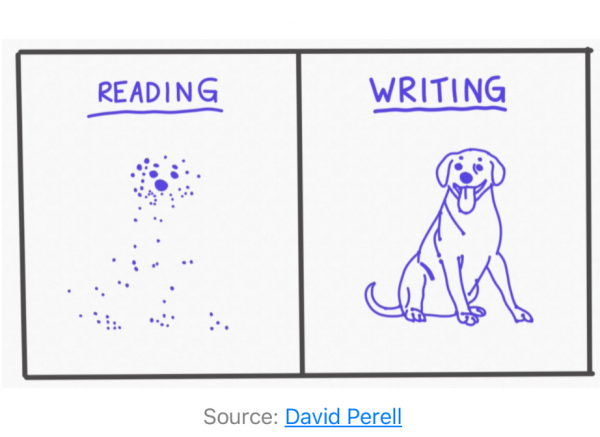

Isn’t this visual super powerful?

The creator of the above sketch, David Perell wrote, “Read to collect the dots, write to connect them.”

While writing is an amazing way to connect the dots, doing or trying out new things (being curious) is also a way to connect the dots.

How about you? How are you connecting the dots or are you simply collecting as many as you can?

Financial professionals who don’t write or experiment with new approaches may find themselves with a wealth of dots—data points, facts, and figures—but no coherent ‘picture’ that helps them guide and communicate with clients in a comprehensive and compelling way. ‘Writing’, or the act of creation and experimentation, forces you to process you have read, to understand it deeply enough to explain it to others, and to find creative solutions to complex financial situations.

Collaboration is another powerful way to connect the dots. By working together, you can pool your collective ‘dots’ of information, experience, and insight. This collaboration can lead to a much richer and more nuanced picture, one that could be far more beneficial to their clients than what any single professional could create alone. Moreover, collaboration can spark innovation—when you bounce ideas off one another, you might discover new ways of thinking or uncover opportunities you hadn’t considered before.

In a field where trust and expertise are paramount, demonstrating the ability to connect dots into a comprehensive strategy can distinguish you in a crowded market. This means not just accumulating knowledge, but also sharing insights through writing articles, developing new tools, or creating informative content for clients.

By doing so, you become a thought leader and go-to expert in your niche. You are not just seen as salespeople or as passive purveyors of financial products but as proactive, knowledgeable professionals who add tangible value to their clients’ financial lives.

In the end, the question for you is not just how many dots you can collect, but how meaningfully you can connect them.

Similar Post

Nano Learning

What are you Paid For?

Let me give you a hint with a James Whistler quote. “An artist is not paid for his labor but for his vision.”

You are an artist too. At least the best ones are. Personal Fina ....

Read More

17 March, 2023 | 2 Minute Read

Nano Learning

The Missing Assets That Create a Truly Scalable Practice

Every time I speak with top MFDs, a common pattern emerges; they measure success by AUM , the funds they deploy, and the commission numbers they post. But there is an unseen side o ....

Read More

31 October, 2025 | 3 Minute Read

Nano Learning

The Way to Price

Pricing is a complex subject (not to mention the creativity that is often required in it) and one that is rarely understood by most people. Knowing the costs of your services is no ....

Read More

20 May, 2022 | 2 Minute Read

Nano Learning

Busy ≠ Effective

A financial professional recently told me, “I’ve never been this busy.” Calls. Reports. Product updates. Market commentary. Chasing transactions. Fixing a KYC error.

27 June, 2025 | 3 Minute Read

Nano Learning

The Missing Assets That Create a Truly Scalable Practice

Every time I speak with top MFDs, a common pattern emerges; they measure success by AUM , the funds they deploy, and the commission numbers they post. But there is an unseen side o ....

Read More

31 October, 2025 | 3 Minute Read

Nano Learning

This is Key for you to Thrive in the Next 3, 10 and 30 years

I am sure most of us would have gone to the gym at some point of time in our lives. What do you do when you exercise?

Do you lift the lightest weight or the heaviest weight?

....

Read More

18 September, 2020 | Minute Read

- 0

- 0

0 Comments