The Hidden Iceberg

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

June 13, 2023 | 7 Minute Read

What is the difference between an account and a relationship?

If there is any confusion about this question, let me clarify this further by making a tiny change.

What is the difference between a client account and a client relationship?

I want you to think deeply about this before I share my answer. And while you have worn your thinking hat, here is another simple question…

How many client accounts and how many client relationships do you have?

Make a note of these questions as their answers are critical for the future and value of your firm. If this is not making sense now, it will as you navigate through this post.

An account is transaction or product-centric. You reach out to your clients when you have a new product to sell or when you need more money/assets (even though you might be doing things in your client’s best interest). And your clients reach out to you to talk about something you should have already known about. In this case, your client’s money is your client. We forget that there are real lives at stake. All we see is a number. That’s why the term Assets Under Management is harped on so much versus Lives Under Management (LUM) or People Under Management (PUM) or Families Under Management (FUM).

A relationship on the other hand is proactive. It is different. You call your client even before they have the chance to think of something that might impact their lives. You care deeply. You keep thinking of ways of making their financial lives better. You are on top of their situation and financial lives. You want to delight them and create a wow experience for them.

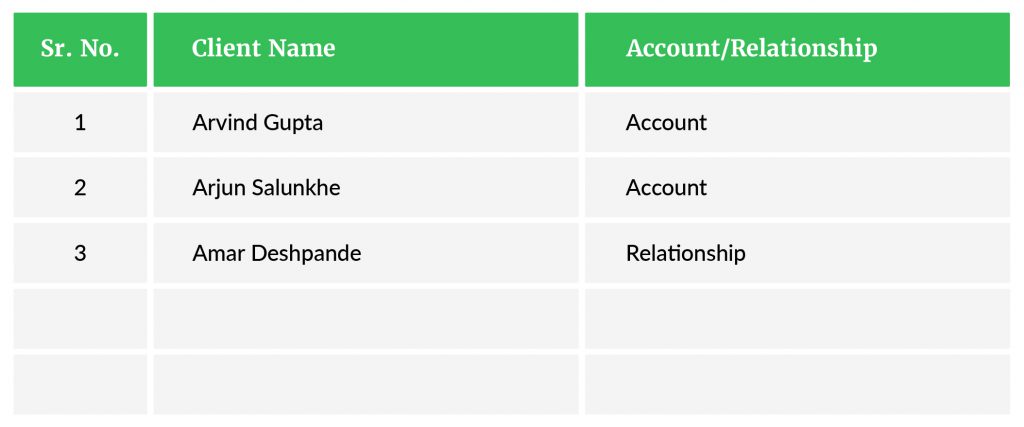

Now that the definitions are out of the way, draw the table given below. Enter your client names and across each name write whether this client is an account or a relationship.

Did you complete this exercise?

You can do this at your leisure but what do you think might be a key observation/insight here. I have given a very generous hint in the table itself.

The insight is as simple – Most people in our industry/profession have more accounts than they have relationships.

Let’s dissect the case of 2 such firms. The first firm has 2 partners and a few team members. They have 1700 clients. The second firm is run by a super hard-working professional. He has 900 clients.

In both these firms, what do you think are the number of accounts and the number of relationships? Each one of you is likely to get this answer right because there is no way to get this one wrong (yet most people overlook this powerful insight). Both firms have more than 96% + accounts and very few relationships.

If you have 900+ clients or on average 850+ in the case of the first firm, there are simply not enough hours in the day or year to take care of your clients in the way I describe a relationship. Do you remember the post “What’s your Dunbar Number?” If not, I would strongly encourage you to read it again and again.

So, what is this number?

According to Wikipedia, “Dunbar’s number is a suggested cognitive limit to the number of people with whom one can maintain stable social relationships. This number was first proposed in the 1990s by British anthropologist Robin Dunbar, who found a correlation between primate brain size and average social group size.[3]

By using the average human brain size and extrapolating from the results of primates, he proposed that humans can comfortably maintain 150 stable relationships.”

Can you really do that in your personal life?

I doubt so…How can we then imagine/think that we will be able to build thousands of intimate financial relationships? Forget thousands, even building a hundred deep relationships is super difficult.

We know this, but things seem fine on the surface for us (after all, markets are doing fine, SIP book is healthy and our cost to income ratio is nice too). So, we choose to ignore the iceberg. We even refuse to believe there is an iceberg hidden right in our business. The iceberg that’s causing our business value to erode. In both the above cases, the founder(s) have built a good book of business, but they have missed an opportunity to build an actual business (and therefore reducing the real value of their business). And there is an iceberg right below their feet now (and it’s not the upcoming TER Cut).

Acknowledging the presence of the hidden iceberg is the first step in protecting the value of your book of business. The second step is to unlock value by transitioning your book of business to an actual business.

Here is what is likely happening… Your best clients (which is a very small percentage of your overall clients) are subsidizing other clients. Majority of your time goes in catering to so many people…or rather everyone. What really happens is that no one is really well looked after. Most of the clients are not even engaged. Some clients (rather the best ones) start feeling neglected. They also do not understand how you are actually different from other professionals in this space. And remember your clients are someone else’s prospects. Your competitors are giving the time, attention and energy to your best clients. It’s therefore easy to move to someone else…even if the firm is not really that better (only the perception that the other firm is better will do the job).

Once again, I want to bring your attention to the most important point – most clients of your firm are fractional clients or accounts. You will see them as whole clients or real people only when they leave you or when they start building a relationship (consolidating accounts) with a competitor.

While all of this is happening, where are we spending, or investing our money, time, energy, and attention on – acquiring more fractional clients aka accounts. We continue to engage in getting more such accounts on board thereby not only eroding the real competitive advantage of this business (deep client relationships) but also our business value even further.

As a wise person once said, “The primary obstacle to future success is your current success.”

Similar Post

Featured

CIQ and Chemical Components

Here is a simple question for you.

What is the most important thing in the First Meeting with a prospective client?

Hint: It starts with C

Another Hint: It’s also important in ....

Read More

4 April, 2023 | 5 Minute Read

Featured

Love, Purple Cow and Angavastram

While the headline might seem a bit odd to you at first, there is indeed some connection among the words. Last week, I was in Chennai to attend “IFA Galaxy’s Summit 2023.” Be ....

Read More

28 February, 2023 | 6 Minute Read

Featured

The True Test of a First Meeting

Ashish, a mutual fund distributor from Kolkata, shared an experience with me recently.

"I met a doctor who had the CNBC app open on one hand while talking to me," he said. "The doc ....

Read More

6 May, 2025 | 7 Minute Read

Featured

The Unbeatable Edge

I received a lot of love for the post “Knife in a Gun Fight”. At the same time, some of you had many questions. One reader wrote, “I lost 2 important clients to a bank and a ....

Read More

12 December, 2023 | 8 Minute Read

Featured

Collecting Content or Creating Change?

We live in a time when content has become the currency of credibility. Every day there is a new blog, a new podcast, a new course, a new manual, a new expert sharing their “secre ....

Read More

7 October, 2025 | 7 Minute Read

- 1

- 2

0 Comments