Why One Size Does Not Fit All in Personal Finance

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

May 7, 2024 | 5 Minute Read

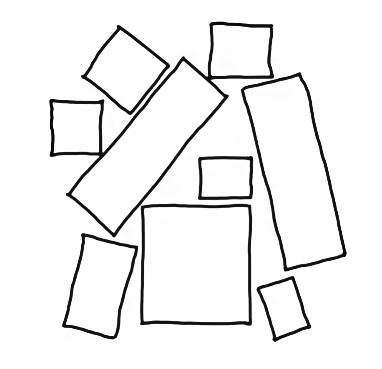

Imagine walking into a store to buy clothes, but instead of picking garments that fit your size, style, and comfort, you choose to buy what your friend wears. It sounds absurd, doesn’t it? Yet, surprisingly, this is how many approach investing—mimicking others’ choices without considering if they’re suited to their personal financial situation and goals. This is one reason why many portfolios are simply a hodgepodge of products. There is no alignment of the portfolio (or money) with the investor’s personal life. Isn’t this what we see on a regular basis? I bet you do…

Here’s why your clients investment portfolio should be as tailor-made as their wardrobes, reflecting their lives, not someone else’s.

Personalization is Key

Just as your client would select clothing to suit his body shape (pardon the gender reference here but this equally applies to everyone), style preferences, and the climate he lives in, his investment portfolio should be customized to his financial situation, risk tolerance, investment timeline, and goals. The financial instruments and strategies right for one person might be entirely unsuitable for another due to different income levels, responsibilities, lifestyles, and future aspirations.

Do prospects understand this in the first meeting with you?

It is very easy to brush this off and say ‘yes’, but it’s a super important point to understand and implement. There might be some changes necessary in your first meeting with a prospective client

Risk Tolerance and Time Horizon

Would your client ever wear his friend’s tight shoes for a marathon just because they’re popular? Likely not, as he would choose footwear that fits well and suits the long distance ahead. Similarly, in investing, your client’s risk tolerance and investment horizon determine the “size” of his investments. If he is risk-averse, a stock-heavy portfolio might keep him up at night, whereas bonds or stable value funds might not provide the growth needed by someone comfortable with high risk and a longer runway.

Financial Goals: As Unique as Your Client’s Life

Your client’s financial goals are a function of his life’s unique journey—just like his wardrobe might change if he moves from a hot climate to a cold one. Someone saving for a home down payment in three years will need a different investment strategy from someone preparing for retirement in three decades. Copying a friend’s or son’s investment, who might be at a different life stage or financial condition, is like wearing their winter jacket in your tropical city—it just doesn’t make sense.

Avoiding the Trap of Performance Envy

It’s easy to feel envious when someone else’s investments outperform yours, just as it might be tempting to envy a friend’s outfit at a party. However, just because something looks good on someone else doesn’t mean it will work for you or your client. Investments, like clothing, should not be chosen based on current trends or external appearances but should be based on how well they help meet your client’s personal goals and objectives.

Custom Tailored Portfolio

A portfolio that is tailor-made for your clients financial needs and goals, much like a custom-tailored suit, will always fit better than something off-the-rack. It considers their personal circumstances, adjusts for their comfort level with risk, and aligns with their future goals. This might mean diversifying across different asset classes, picking investments that offer growth or income at different stages of their life, and adjusting the mix as their life changes.

Conclusion

Your clients investment portfolio is not a one-size-fits-all garment but a bespoke ensemble designed to fit their lives perfectly. Just as your client wouldn’t wear someone else’s outfit to an important event, he shouldn’t mirror someone else’s investment strategy. By ensuring your clients investment choices are tailored to their personal financial situation and goals, they’ll not only wear their investments comfortably but they’ll also be on their way to achieving their financial goals, stress-free and with confidence. Remember, in the world of investing, the best fit is always personal.

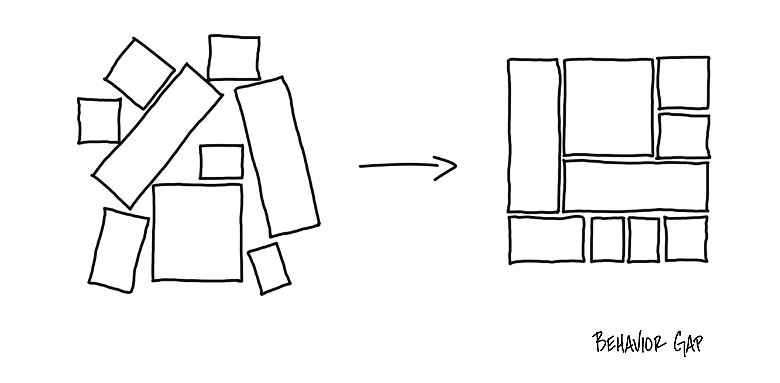

And when it’s done the right way (by real professionals), this is how it will look.

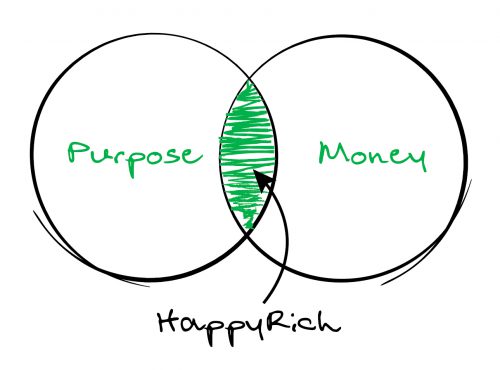

On May 11th, 2024, we will complete 19 years of creating such world class personalized portfolios for investors. We will complete 19 years of helping people align the use of their capital with what’s important to them. We will complete 19 years of helping people live a HappyRich Life.

As we approach the remarkable milestone of 19 years, it feels both humbling and exhilarating to pause and reflect on the journey we’ve shared. This momentous day is not just a measure of time but one of amazing relationships, growth, and shared successes that we’ve crafted together.

To our valued Happyness Factory partners across India, thank you for your trust and collaboration. Your dedication and passion in making a real difference in the lives of your clients have been integral to our journey. Together, we have built a network of excellence and trust that continues to enrich lives across the nation.

To our esteemed clients, thank you for entrusting us with the profound responsibility of guiding your financial paths. Your faith in our abilities to help you live the life you have imagined with your money (not to forget creating world-class personalized portfolios) has been the cornerstone of our firm. The stories of how we’ve helped align your capital with what’s truly significant in your lives, and seeing you live your HappyRich Life, are the narratives that inspire us every day. There are so many of them and we count them as our blessings.

To our dedicated team members, your unwavering commitment, tireless work, and endless creativity have been the heartbeat of our operations. Each one of you plays a crucial role in transforming our vision into reality, ensuring every decision we make and every action we take is infused with our core values and dedication to taking world class care of our clients.

To everyone who has been a part of this incredible journey, your support has been the wind beneath our wings. It has propelled us forward, through challenges and triumphs alike, and has allowed us to reach new heights year after year.

As we celebrate this anniversary, we do so with immense gratitude and a deep sense of appreciation. We look forward to continuing to serve you with the integrity, passion, care, and excellence that have been the hallmarks of our past 19 years. Here’s to many more years of partnership, prosperity, and shared joy.

Similar Post

Featured

The Centaur Way

What comes to mind when you hear the word “Centaur”?

For Mumbaikars, the word “Centaur” reminds us of either the erstwhile Centaur Hotel (Sahara Star in its current avatar ....

Read More

18 July, 2023 | 5 Minute Read

Featured

The Ancient Hidden Secret

Robin Sharma in his book “Who Will Cry When You Die?” wrote a powerful story from ancient Indian mythology. The story resonated so deeply with today’s topic that I immediatel ....

Read More

24 October, 2023 | 6 Minute Read

Featured

The Investor Sitting Across The Table? (Part 2)

In Part 1, we explored the three investor personas laid out by behavioral finance expert Meir Statman: Utilitarian, Expressive, and Emotional. As a Mutual Fund Distributor (MFD) or ....

Read More

12 August, 2025 | 8 Minute Read

Featured

The Founders Dilemma: Navigating Time Traps

Last week, I hosted an Ask Me Anything session called “Ask Amar”. While I answered many questions on growth, marketing, strategy, first meetings, succession, valuation and so o ....

Read More

20 February, 2024 | 6 Minute Read

Featured

Letter to Mahesh Ramaswamy

My Dear Mahesh,

It feels almost impossible to write these words. To speak of you in the past tense, when every part of me wants to believe I’ll see your familiar smile walking t ....

Read More

8 July, 2025 | 4 Minute Read

Featured

This Magic Pill will solve all your problems...

Tell me if this sounds familiar.

● You are wasting time working with too many non-ideal clients who blame you for everything that ever goes wrong.

● You aren’t sure ....

Read More

3 August, 2021 | 6 Minute Read

- 0

- 0

0 Comments