The Risks of Choosing a Successor Driven by Valuation

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

September 3, 2024 | 5 Minute Read

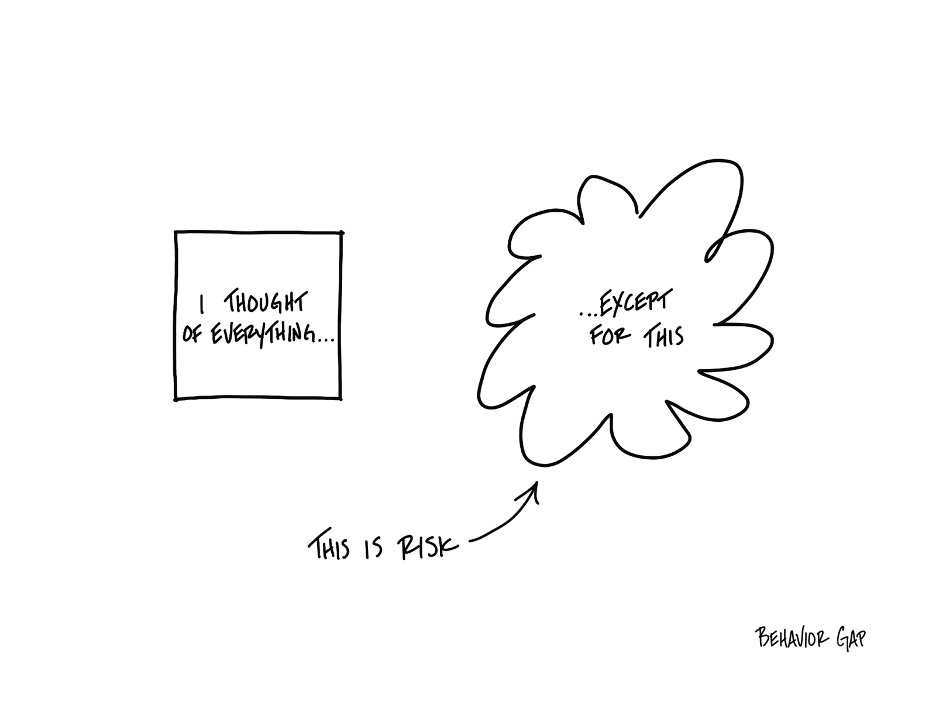

This post is the third in my recent series on succession planning. In the first post, I shared Sunil’s story and the challenges of transitioning a financial practice (you can read it here). The second post focused on the 7 Key Factors for Selecting the Right Successor or Exit Partner. Now, in this third instalment, we’ll go through the risks that you need to be aware of when considering a successor.

In our industry, the decision to pass on your practice is as much about safeguarding your clients’ futures as it is about preserving your legacy. When considering a successor, the choice often comes down to not just who can pay the most, but who can deliver the same (or better) level of service, client experience, and care that your clients have come to expect.This is especially critical when your practice is a complex one, like Sunil’s, with Rs. 300 Crore in assets under management and 700 clients.

In another case, Ramesh (who has 1200 clients and Rs. 550 Crore of AUM) faces a potential successor, which is a firm that has built a technology platform primarily for insurance and is now getting into mutual funds. This firm, however, has never truly engaged in client care or understood the nuances of managing client relationships in this domain. Their interest in Ramesh’s practice is driven largely by acquiring AUM, not by a commitment to upholding the standards and values that have defined Ramesh’s success. Here’s why Ramesh should be cautious:

1. Lack of Experience in Handling Complex Transitions

This firm has never executed a practice transition before, especially one as intricate as Ramesh’s. While they might have created a platform that works for a broad consumer base or advisors, they lack the hands-on experience required to manage a comprehensive client transition. The process of transferring assets, maintaining client relationships, and ensuring continuity of service involves meticulous planning and execution. Without a deep understanding of these processes, the firm may underestimate the complexities involved, leading to delays, errors, and, most critically, client dissatisfaction.

The key questions for you are, “Who is going to handle the transition? Who is going to manage the clients? What kind of care will you deliver to my clients?”

2. Risk of Client Attrition

Ramesh’s clients are accustomed to a certain standard of personalized service and communication. A firm primarily driven by platform management and valuation metrics may not have the same depth of understanding of these clients’ individual needs. This disconnect could lead to clients feeling neglected or underserved, prompting them to seek out other financial professionals who can offer the reassurance and stability they require. Ramesh’s clients, who have placed their trust in him over the years, could be at risk of leaving if they sense a shift away from the personalized care they have received.

3. Potential for Operational Disruption

The firm in question, with its focus on platform efficiency rather than client experience and care, may not have the necessary infrastructure or support system in place to handle the sudden influx of new clients. This could lead to operational bottlenecks, delayed responses to client inquiries, and a general decline in service quality. For a seasoned professional like Ramesh, whose reputation is built on reliability and excellence, this is a significant risk. Operational disruptions can quickly erode client trust, particularly if they feel their needs are not being met in a timely and professional manner.

4. Inadequate Knowledge of Client Portfolios

Ramesh’s clients have complex financial situations, with portfolios that have been carefully curated over the years. The firm, with its lack of direct client engagement experience, may not fully understand the intricacies of these portfolios. This could lead to suboptimal investment decisions, potentially putting clients’ financial goals at risk. Moreover, the firm’s emphasis on scalability and efficiency might lead to a one-size-fits-all approach, rather than the tailored strategies that Ramesh’s clients have come to expect. This could undermine the trust that clients have placed in Ramesh’s practice over the years.

5. Cultural Mismatch

The firm’s approach to client care and investment philosophy may differ significantly from Ramesh’s. If their primary motivation is driven by valuations and platform growth rather than client-centric care, there is a substantial risk that the quality of service will decline. Ramesh’s practice has thrived on a culture of personal engagement, trust, and meticulous attention to client needs. A successor who does not share these values may struggle to maintain the same level of client delight, leading to potential attrition and dissatisfaction.

6. Risk of Reputational Damage

If the transition is not handled well, it could damage Ramesh’s reputation, both with his current clients and within the industry. This is particularly concerning if clients begin to share their negative experiences with others, leading to a broader impact on Ramesh’s legacy and the long-term success of the practice. The firm’s inexperience in handling client relationships, combined with a potential cultural mismatch, increases the likelihood of reputational harm, which could have lasting consequences for Ramesh and his practice.

Why Experience and Values Matter

The decision to sell a financial practice or find a successor or collaborate with a partner (there is an interesting story I am going to share on this front) is not one to be taken lightly. It involves much more than simply transferring assets and signing contracts. It requires a deep understanding of the work involved, a commitment to maintaining client relationships, and a cultural alignment that ensures the continued success of the practice.

While this firm may present an attractive offer driven by valuation metrics, their lack of experience in direct client care, combined with a possible cultural mismatch, poses significant risks to Ramesh’s legacy and his clients’ well-being. A successor must not only be capable of handling the operational aspects of the transition but must also embody the values and principles that have defined your practice.

For Ramesh, the choice of successor is one of the most critical decisions he will make in his career. It’s not just about finding someone to take over the practice; it’s about finding the right partner who can uphold the standards and values that have made the practice successful. By choosing wisely, Ramesh can ensure that his legacy is preserved, and his clients continue to receive the care and attention they deserve in the future.

Similar Post

Succession Planning

Are You Mithunda?

I was speaking with a gentleman about Succession Planning, but it was apparent he was confusing this with sale planning or selling the business. The word Succession Planning is oft ....

Read More

7 February, 2023 | 5 Minute Read

Succession Planning

The Succession Mirage

There is a story I want to share with you.

A story that repeats itself more often than we admit.

A story that looks like succession from the outside, but in reality, is only a chan ....

Read More

16 December, 2025 | 7 Minute Read

Succession Planning

A Tale of Two ….

I know the headline is incomplete but what’s the word that comes to your mind when you read the headline?

If you are like many, chances are you are thinking about Charles Dicken� ....

Read More

11 July, 2023 | 6 Minute Read

Succession Planning

Are You Mithunda?

I was speaking with a gentleman about Succession Planning, but it was apparent he was confusing this with sale planning or selling the business. The word Succession Planning is oft ....

Read More

7 February, 2023 | 5 Minute Read

Succession Planning

Insights to Remember When Selling Your Practice

Many financial professionals think they are ready to buy a practice.

Few actually are.

Buying a practice is not like buying a house. It’s not just a transaction. It’s about tak ....

Read More

4 March, 2025 | 5 Minute Read

Succession Planning

The Misunderstood Necessity: A Deep Dive into Succession Planning

'I have formed an LLP. I think my succession planning is done,' said Sachin, a mutual fund distributor from Mumbai. Another professional stated, 'I am joining hands with another pe ....

Read More

12 March, 2024 | 7 Minute Read

- 0

- 1

0 Comments