The Legend of Compounding (IFA Version)

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

September 1, 2020 | 6 Minute Read

I am sure you would have guessed who the legend of compounding is but before I get into writing about this, let me narrate a few lines from a brilliant book “Boombustology” by Harvard Business School Professor Vikram Mansharamani.

In the book, Professor Mansharamani writes “Imagine if, upon Cleopatra’s death in 30 BC, some public-spirited heir to the Egyptian ruler had made a gift to posterity (all future generations) of $100 deposit in the Bank of Perpetuity. Just reinvest the interest at 2% forever and ever, the donor would have told the teller and do not allow a single withdrawal. This benefaction (a benefit or donation), seemingly very little on the day of the deposit, would by now have grown to $41,034,747,782,825,800,000. Expressed more manageably, it would represent 58.5 doublings of the original $ 100, or $ 5,351,505,546.32 for every citizen of the world.”

$5.3 billion for each one of the 7.6 billion population. This means all of us are billionaires 5 times over. Are you shocked? Even I was, though I know the power of compounding. I just could not imagine the enormity of the number at 58.5 doublings even though I had written a similar story of a Persian emperor who lost his kingdom to the Power of Compounding. I understand the compounding concept viscerally and visually, yet I could not come up with a number of $5.3 billion for every person on this planet. This is because our mind is capable of linear thinking and progression but not exponential things.

However, this $5.3 billion is like the numbers that we crunch on Excel otherwise all of us would have been billionaires by now. I will come to the reason why it didn’t happen but I can give you a hint – Humans are capable of infinite stupidity (I can assure you that this number is seriously high and we all are guilty of stupid things – after all that’s what makes us Human).

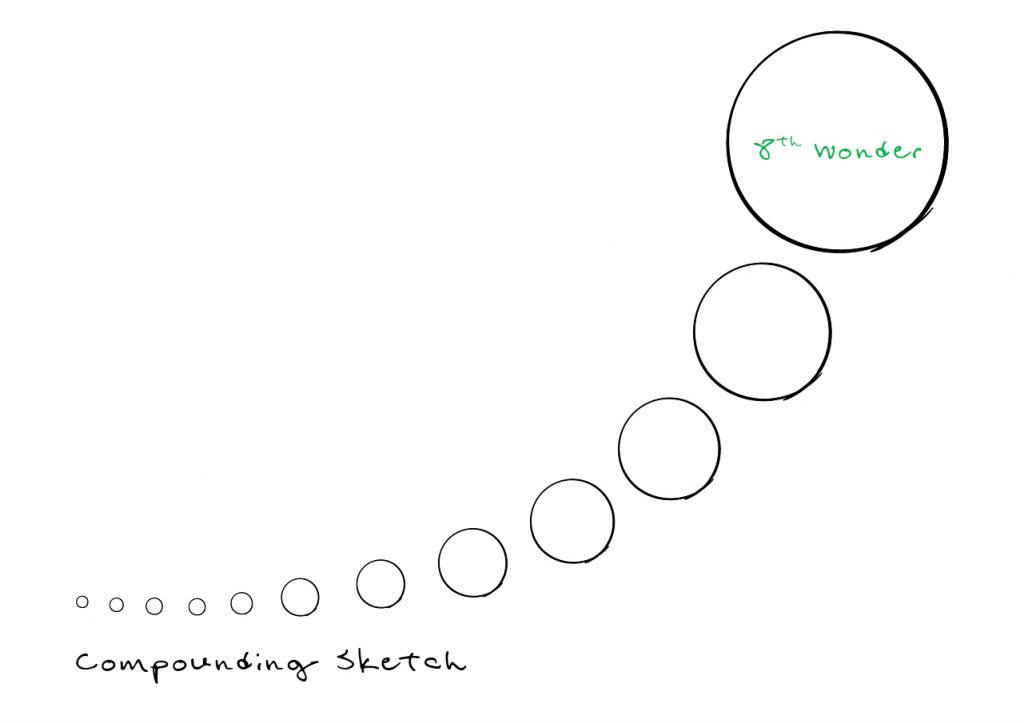

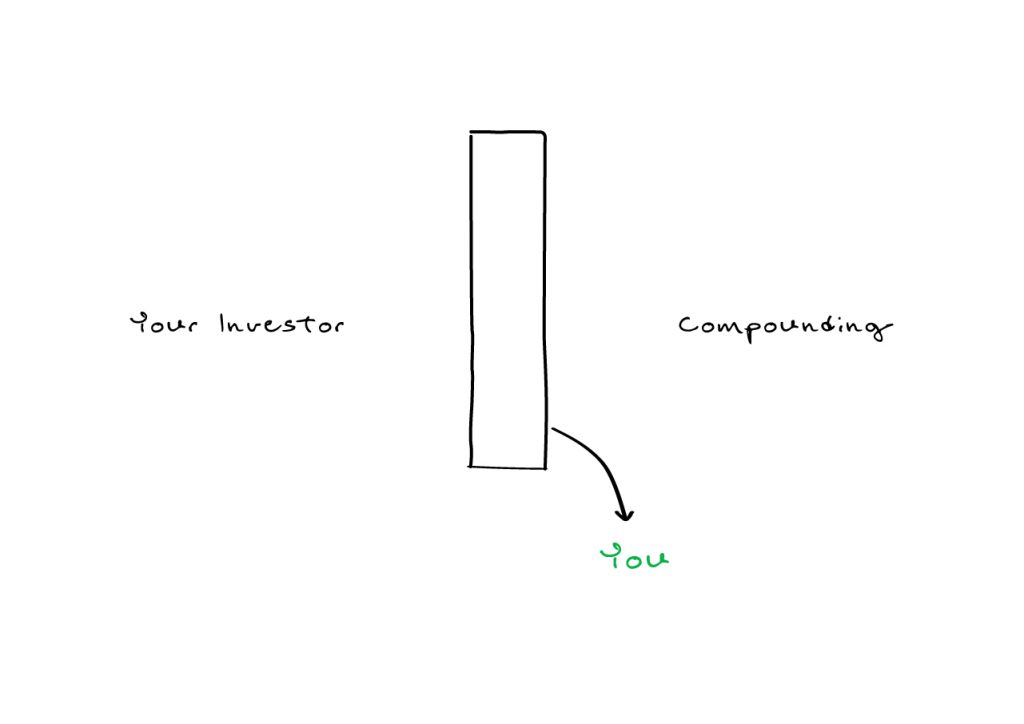

One of the fundamental reasons for us not getting the benefits of Compounding is that we do not understand the real power of Compounding even though we talk about it quite often. The real problem is that we understand it from a Maths perspective, but we are not able to Visualize the Power of compounding and how it plays a key role in our Investor’s portfolio and overall financial well-being. You will even realize that the most important role that you play in a client’s life is something very different than what you think. I shall illustrate your key role through Sketch 2. I am sure you understand that your clients are not able to visualize that even Rs.1 Lakh invested at a child’s birth can make her a Crorepati (Rs. 1.28 Crore) by age 42.

Second, we think compounding takes 3,5 and 10 years. It does not. Compounding takes more than 20 years to show its real impact and from there it shoots like a rocket. Thus, it takes decades for us to realize the power of compounding. Compounding is very slow at first and you may not even realize its impact initially even in the first 10 years. Make sure your clients understand that compounding will not even be seen in the first 5-10 years.

I have drawn a Sketch to illustrate the above points to you.

This is where the Legend of Compounding comes in. He is none other than the Legendary Warren Buffett. He turned 90 on 30th August 2020. Imagine the compounding cycles his investments have gone through and you would be surprised to know that 95% + of his net worth that we see today was after his age 65. In fact, $89 billion of his $90 billion of his financial wealth came after age 65. Isn’t this crazy? Do not lose hope. You still have a long way to go :-).

People are now living longer so time is not an issue for most people. There is enough time to compound and if you look at intergenerational wealth then there is a lot of time for compounding to make wonders for your investors. The real problem though for most investors is that “they don’t leave compounding alone.” Once they start investing, they stop at some point of time, listening to counsel and wisdom from the media, friends, family, gloom doom gurus and idiots (remember human stupidity is infinite and there are many peddlers of believable bullshit).

The key is to Leave Compounding Alone to do its job. Imagine you are doing your best work, and someone keeps nagging you continuously and even interferes with your work. I am sure you know the outcome of this. The same happens with Compounding when investors do not let it do its job. Leave the damn thing alone should be our Mantra.

There is a Blaise Pascal quote that is so apt to this situation and I remember it so vividly “All of humanity’s problems stem from our inability to sit quietly in a room alone.” I would make a slight modification to this one and say, “All of investors’ problems come from their inability to sit quietly with their portfolios.”

Your key role as a financial coach is to get your investors to leave Compounding alone. Yes, get your investors to leave their portfolio alone. Sadly, many investors do not understand the power of this nor do financial advisors or distributors. The real ones however understand the power of this and will do whatever it takes to get their clients to leave compounding alone. However, it is important that your clients give you permission to do so.

Einstein said, “Compounding is the Eighth Wonder of the World”. I would say it is the First and Most Important Wonder not just in Investing but in every walk of Life. If there is one Wonder that you must Visualize and See, it is this Wonder of Compounding. There is no other wonder that is as powerful as this but unless you get your investors to leave this Wonder alone, they might never get to Experience the Power of the Eighth Wonder of the world.

P.S. I have written an Investor Version of this column that you can find here. You can share this column however you want with your investors. Subscribe to www.happyrichinvestor.com for more such insightful content.

Similar Post

Growth

The 3 Phases of doing Anything New

The first phase is the Overthinking phase. Will this work?

You keep thinking, thinking, and then give up thinking. Then you see others doing it and you are tempted to do it. So, y ....

Read More

9 July, 2021 | 2 Minute Read

Growth

The Secret

I think the open rates for this post will likely be higher. After all, we love secrets, magic pills, tips, tricks and hacks. And while there is indeed a powerful secret, there are ....

Read More

9 May, 2023 | 6 Minute Read

Growth

Want to Get Exponential Results?

Have you heard of the Pareto Principle?

Not only would you have heard of this, but I believe that you might also know this quite well. It’s the idea, introduced in the 1790s by ....

Read More

27 December, 2022 | 5 Minute Read

Growth

Did you know these?

One of my readers (Sagar – name not changed) wrote to me about how this blog has been helping him. One of the interesting points he wrote – “Well, it encourages me to stand i ....

Read More

1 November, 2022 | 5 Minute Read

Growth

The Future is What you Make of It

I launched this blog for you on January 3rd, 2020, and what a ride it has been since then. More than 2500+ of you are reading the blog on a regular basis and many are sharing their ....

Read More

4 January, 2022 | 7 Minute Read

Growth

TUM is the Future

Normally I end my post with a quote, but I thought of doing it differently this time. I will share a Diane Berenbaum quote and then build a case to connect it with the headline. In ....

Read More

26 July, 2022 | 6 Minute Read

- 3

- 0

0 Comments