Psychological Flexibility and You

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

August 29, 2025 | 3 Minute Read

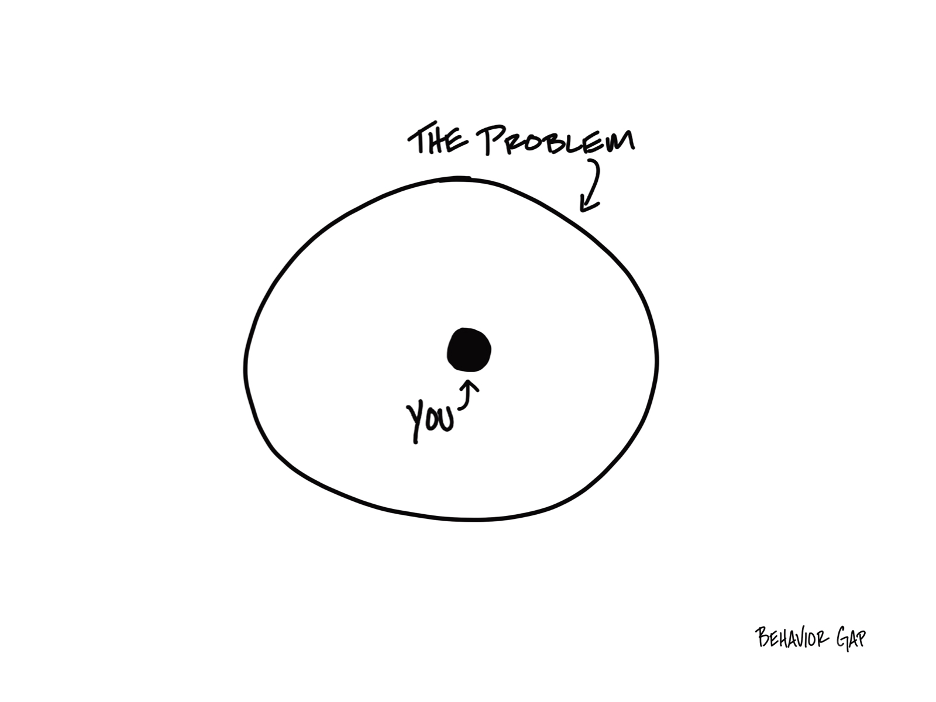

In psychology, there is a concept called psychological flexibility.

It is the ability to respond to obstacles successfully while continuing to move toward your chosen goals, even when the path is emotionally tough.

It means you acknowledge and accept your emotions. You do not pretend they are not there. But you also do not let them control you.

For financial professionals, this is more than a theory. It is a survival skill.

Markets will rise and fall. Clients will sometimes make impulsive decisions. Regulators will change rules. Competitors will try to lure away your clients. These events will trigger emotions such as frustration, fear, anger, self-doubt.

The easy reaction is to let those emotions take the driver’s seat. To panic when clients panic. To abandon your process because the noise is too loud. To take shortcuts because the long game suddenly feels hard.

Psychological flexibility is about doing the opposite.

You feel the fear but still follow your plan. You hear the noise but stay committed to your clients’ long-term interests. You acknowledge the frustration but still make the next right call.

Think about it like a seasoned marathon runner. Midway through the race, their legs hurt. Their lungs burn. The weather changes. The crowd starts disappearing. They do not deny these challenges. But they keep moving toward the finish line because they know why they started.

In your work, your “finish line” is your clients’ success. It is their financial security. Their ability to live the life they have imagined.

When you practice psychological flexibility, you stop letting temporary discomfort dictate permanent decisions. You focus on what matters, even when it is hard.

That is how you become the kind of financial professional your clients can trust. Not because you never face challenges. But because you keep moving forward, no matter what.

Similar Post

Nano Learning

The Gap We Need to Bridge

Can you guess what this headline refers to?

All right, I will give it as I don’t have the luxury of creating all the suspense.

We all know the concept of left brain versus right ....

Read More

10 June, 2022 | 2 Minute Read

Nano Learning

Promise and Expectations

As we know, Trust and Truth are the 2 pillars of our industry and profession. All the work we do is based on the foundation of trust and truth. Maintaining a lifetime of trust with ....

Read More

18 March, 2022 | 2 Minute Read

Nano Learning

Are you Playing Office Office?

I have seen many distributors and advisors playing Office Office.

The game goes like this.

We think if only I had this website or that team or that logo, I would acquire clients. ....

Read More

29 January, 2021 | 2 Minute Read

Nano Learning

Your Sworn Enemy

I must work hard to keep this enemy away. I bet you must too.

In case you are wondering what I am referring to, let me quote philosopher Epictetus, “It is impossible for a pers ....

Read More

25 April, 2024 | 2 Minute Read

Nano Learning

Incidental Advice and Responsible Distribution

Incidental advice is at the core of responsible distribution.

The SEBI Chief has made it clear—mutual fund distributors are allowed to give incidental advice. But what does this ....

Read More

13 March, 2025 | 2 Minute Read

Nano Learning

The Hypocrisy Trap

I recently met Ram, a mutual fund distributor who was frustrated with his client’s behavior. “My client wants to get investment guidance from his uncle,” he complained. “He ....

Read More

30 August, 2024 | 2 Minute Read

- 0

- 0

0 Comments