Bust your E-Myth

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

June 28, 2022 | 5 Minute Read

There is a wonderful quote by computer scientist Alan Kay (on the value of looking at old things in a new way) – “A change in perspective is worth 80 IQ points.”

Well, I don’t know whether this post will have an impact of 80 IQ points (I certainly hope so), the book “The E-Myth Revisited” by Michael E Gerber will certainly have that impact. Though the book was originally written in 1986 and then Revisited in 1995, it is as relevant today as it was 36 years back.

When I first heard of the book in 2000 (during the dot com days), I thought it had something to do with E-commerce and dismissed it. Shortly, I bumped into this book once again and this time, I took the effort to read the complete title of the book. It was “The E-Myth Revisited – Why Most Small Businesses Don’t Work and What To Do About It.” By the way, E-Myth stands for Entrepreneurial Myth.

Don’t be alarmed by the title and say “My business works. I don’t need it.” I know your business works, but I assure you that this book will provide you the change in perspective you need TODAY. Didn’t I say I was going to do that with the post? Let’ shoot for the 80 IQ points.

The book in its introduction has a quote that is likely to resonate with everyone (whether you are a business owner, team member, shareholder, or vendor to that business). The quote is by Joseph Heller, and it reads “I think that maybe inside any business, there is someone slowly growing crazy.”

Gerber writes “To understand the E-Myth, let’s take a closer look at the person who goes into business. Not after he goes into business, but before.”

For that matter, where were you before you started your business?

Well, if you are like most people, you were working somewhere else.

What were you doing?

Probably technical work, like almost everybody who goes into business.

You were a carpenter, a mechanic, a bookkeeper, real estate agent, an accountant, salesperson, or a marketing person. Whatever you were, you were doing technical work. And you were damn good at it. In your case, you were a financial professional or technician.

Then one day for no apparent reason, something happened. It might have been a feeling that you are not appreciated by your boss or the weather. It could have been anything; it doesn’t matter what. But that day, you were suddenly stricken with an Entrepreneurial Seizure.

Inside your mind, it sounded like this “Any dummy can run a business. I am working for one.” And the moment you paid attention to what you were saying and really took it to heart, your fate was sealed. The idea of being your own boss, doing your own thing, singing your own song became obsessively irresistible.

If this is so, you fell victim to the most disastrous assumption anyone can make about going into business.

That fatal assumption (and E-Myth is): if you understand the technical work of a business, you understand a business that does technical work.

Read this again because this is the root cause of most small business frustrations and failures.

The technical work of a business and a business that does that technical work are two totally different things.

The real tragedy is that when the technician falls prey to the Fatal Assumption, the business that was supposed to free him from the limitations of working for someone else actually enslaves him.

Suddenly the job he knew how to do so well becomes one job he knows PLUS a dozen others he doesn’t know how to do at all.

Isn’t this true for most people in our industry and profession too?

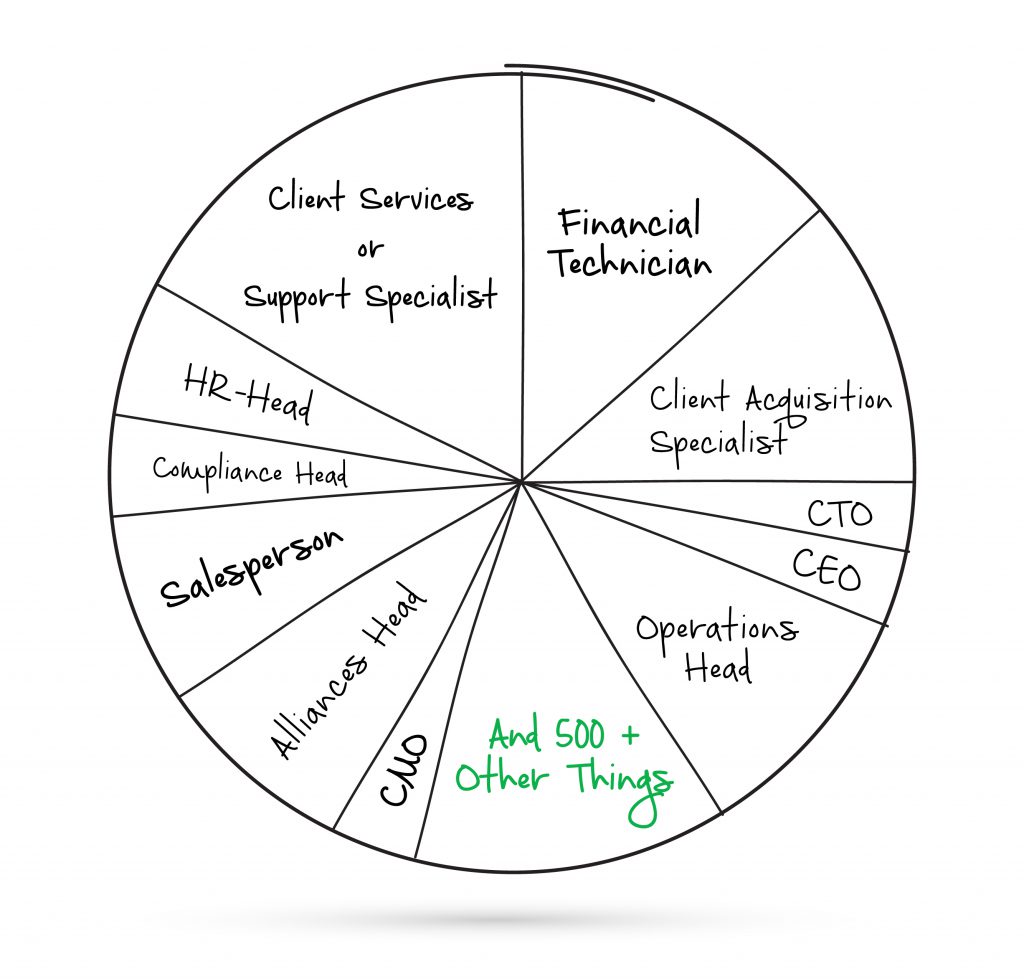

You are the financial technician in your business.

You are the CEO.

You are the Rainmaker or Salesperson or Client Acquisition Specialist.

You are the CMO (Chief Marketing Officer).

You are the Operations Head.

You are the Client Services or Support Specialist

You are the CHRO or HR-Head.

You are the CTO.

You are the Alliances Head.

You are the Compliance Head.

And 500 + Other Things.

The List goes on. In Short you are the financial technician plus Chief Everything Officer.

But how skilled are you in each or any of these roles? And how well do you play them?

Most importantly, do you even have time to work on any of these roles? I doubt so.

Many of us don’t find the time to work on these roles.

Do You?

I have often mentioned this line – “There is a difference between working IN the business and working ON the business.”

Working IN the business means being a great technician. The end result is a Practice or a Partnership firm (if there are 2 partners). You spend most of your time on the technical parts of your business. I don’t need to repeat them. You absolutely know what they are. Just because you have formed a Company does not mean you have built a business. A company is simply a structure. However, with a real business, you actually spend most of your time working ON the business (in an executive capacity, recruiting and building the business) and less and less in a technical role.

I repeat Gerber’s line again, “The technical work of a business and a business that does that technical work are two totally different things.”

Understanding this difference is the first step to bust the E-Myth and build a great business.

Pat yourself on the back if you are doing great technical work. But are you building a great business that does this technical work?

I am curious to hear from you.

Similar Post

Growth

What type of Financial Professional are you?

It is 2021 yet it somehow feels like 2020 has not ended. The COVID-19 pandemic has changed the world, our lives, and the way we do business. There is a lot of discussion about the ....

Read More

5 January, 2021 | 6 Minute Read

Growth

The Secret to Explosive Growth

“I don’t want to collaborate,” said Ram, a financial professional in India managing Rs. 200 Crore (approximately $25 million) in assets. This sentiment, though common, is a s ....

Read More

9 July, 2024 | 5 Minute Read

Growth

The 3 Phases of doing Anything New

The first phase is the Overthinking phase. Will this work?

You keep thinking, thinking, and then give up thinking. Then you see others doing it and you are tempted to do it. So, y ....

Read More

9 July, 2021 | 2 Minute Read

Growth

A Rule For The Industry

I read a very interesting Bloomberg post “Two Rothschild Bank Clans Fight Over Clients, Power and the Family Name.” The explanation of this headline – The Swiss and French br ....

Read More

9 April, 2024 | 6 Minute Read

Growth

Do HNI’s understand Goal Based Investing? (Part 1/2)

Vijay Venkatraman asked me to participate in a discussion in his conference on 6 and 7th January 2020. The topic I was told was that IFA’s tell him HNI’s don’t understand Goa ....

Read More

3 January, 2020 | 3 Minute Read

- 0

- 1

0 Comments