Where Do You Deliver Value?

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

January 7, 2025 | 5 Minute Read

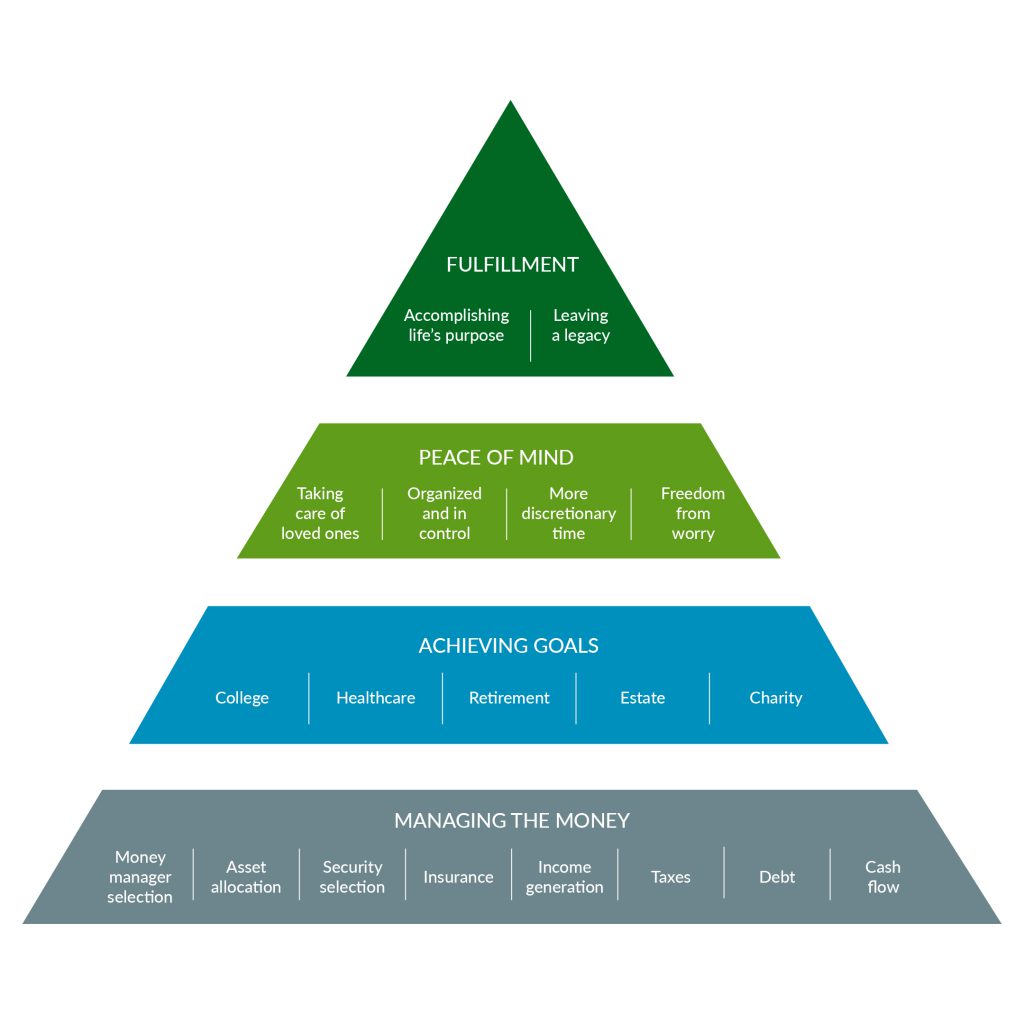

Inspired by Bain & Company’s Elements of Value, Fidelity in 2017 introduced the Advice Value Stack to help wealth firms maximize the value they deliver to clients—and grow their businesses. As the image shows, the pyramid starts with Managing the Money, but that’s just the foundation. True value, the kind that sets you apart, lies in the higher layers.

Managing the money. That’s where most wealth firms play. It’s the foundation of the pyramid. It’s where the competition is fierce. And yet, it’s also where the value you deliver is the most commoditized.

Let’s think about this.

If all you focus on is managing money—picking funds, allocating assets, managing portfolios—then what truly differentiates you? Any robo-advisor can do this now. Many low-cost platforms promise the same results. The “how” of investing has been automated.

Managing money is important. It’s essential. But it’s no longer where you win.

The Layers of Value: Moving Beyond the Foundation

Look at the pyramid.

At the base is “Managing the Money.” That’s where the conversation starts. You help clients select managers, allocate assets, optimize taxes, and generate income. But let’s be honest—these services are table stakes now.

When clients hire you, they assume you’ll do these things well. This is the minimum expectation. It’s not where loyalty is built. It’s not where trust is deepened. And it’s not where clients see transformational value.

If you stop here, you’re replaceable.

The real opportunity lies higher up the pyramid. That’s where you change lives.

Achieving Goals: The Next Step Up

Beyond managing money is Achieving Goals. This is where your value starts to shine.

Clients aren’t investing for the sake of investing. They’re investing to achieve something—to send their kids to college, to retire comfortably, to provide for aging parents, or to leave a legacy.

Your role here is to connect their money to their goals. You’re not just managing investments; you’re managing outcomes.

Here’s where many firms make mistakes. They focus on the technical part—projecting numbers, running calculations, presenting charts. But what clients really want is confidence.

They want to know: Am I doing ok? Am I on track? Can I achieve what matters most to me? What do I need to do to get there?

Help them answer these questions. Show them a clear path. And don’t just monitor their progress—celebrate it. When a client meets a milestone, acknowledge it. Let them feel the impact of your work.

Peace of Mind: Where Trust Is Built

The next level up is Peace of Mind. This is where you go from being a service provider to being a trusted guide.

Managing the money and achieving goals are about the “what” of the work you do. Peace of mind is about the “how”—how you make clients feel.

Do they feel cared for? Do they feel confident and in control? Do they sleep better at night knowing you’re there for them?

Peace of mind isn’t about beating benchmarks. It’s about eliminating worry. It’s about organizing their financial life so they’re not overwhelmed. It’s about giving them more time—discretionary time—to focus on what they love.

And it’s about showing up for them when it matters most.

For many clients, financial peace of mind is priceless. If you can deliver it, you become irreplaceable.

Fulfillment: The Pinnacle of Value

At the top of the pyramid is Fulfillment. This is where true impact happens. This is where your work becomes about purpose.

Fulfillment is about helping clients accomplish what matters most in life. It’s about aligning their money with their values. It’s about leaving a legacy that lasts.

For some, fulfillment means funding a charity or starting a foundation. For others, it means supporting their family across generations. For others still, it’s about achieving the freedom to live life on their own terms.

Your job is to help them discover what fulfillment means to them. Then, you create the plan to make it happen.

At this level, you’re not just a financial professional. You’re a life coach. You’re helping clients live a meaningful life, one that aligns their purpose with their wealth.

Where Most Wealth Firms Go Wrong

Too many wealth firms focus only on the base of the pyramid. They compete on managing money—fees, performance, products. They fight over who can do it cheaper or faster.

But this is a race to the bottom. It’s a game you can’t win. There will always be someone willing to charge less. There will always be a new app promising the same results.

Managing money is foundational, but it’s not enough. Clients expect more. They want someone who can connect their wealth to their life. Someone who understands their goals, eases their worries, and helps them find fulfillment.

The Opportunity for Founders

If you’re a founder of a wealth firm, ask yourself:

Where are you delivering value today?

Are you stuck at the bottom of the pyramid, competing on products and fees? Or are you moving up the value chain, creating deeper, more meaningful relationships with your clients?

The opportunity is clear. To differentiate your firm, you need to operate at the top of the pyramid. You need to focus on peace of mind and fulfillment. That’s where loyalty is built. That’s where referrals happen. And that’s where your firm grows.

The Questions You Need to Ask

To operate at this level, you need to ask yourself:

- Do I know my clients’ goals—not just financial goals, but life goals?

- Am I helping my clients achieve peace of mind? Do they feel organized, confident, and in control?

- Am I creating a path to fulfillment? Do my clients see their wealth as a tool to live a meaningful life?

- Am I delivering value that goes beyond managing the money?

What Clients Are Really Looking For

Clients aren’t looking for someone to beat the market. They’re looking for someone to help them live better lives. They want someone who understands them, who cares about them, and who helps them achieve what matters most.

They want peace of mind. They want clarity. And ultimately, they want fulfillment.

This is where the real work happens. It’s not about products or portfolios. It’s about people. It’s about understanding their lives, their dreams, and their worries.

If you can deliver this, you’ll build a firm that stands apart. A firm that clients trust. A firm that grows sustainably over time.

Moving Up the Pyramid

So, where do you start?

You start by shifting your focus. Stop thinking like an investment manager. Start thinking like a financial life coach.

Spend time getting to know your clients. Understand their fears, their aspirations, and their purpose. Build plans that connect their wealth to their lives.

Create systems that deliver peace of mind. Help them organize their financial life. Show up when they need you most.

And most importantly, help them find fulfillment. Help them align their wealth with their values. Help them live a life that’s meaningful to them.

The Future of Wealth

The future of the wealth business isn’t about managing money. It’s about managing lives.

The most successful firms will be the ones that operate at the top of the pyramid. They’ll focus on delivering peace of mind and fulfillment. They’ll go beyond investments and create real impact.

As a founder, you have a choice. You can compete at the base. Or you can rise above. You can deliver the kind of value that changes lives.

Because at the end of the day, managing the money is just the start. The real work is about helping clients achieve what matters most.

Operate at the top of the pyramid. That’s where the future lies. That’s where your firm’s real value is created.

Similar Post

Featured

Chasing the Next Big Thing

We live in a world obsessed with the next big thing. Everywhere you look, there is someone announcing the latest hack, shortcut, or trend. A new idea gets shared on social media, ....

Read More

30 September, 2025 | 5 Minute Read

Featured

Reflections and The Best Of 2023

Author Dr.Julia Shaw in her book, “The Memory Illusion”, wrote, “Memory is a hodgepodge of fact, fiction, and fantasy.”

Why am I telling you this?

It’s because we rely ....

Read More

26 December, 2023 | 7 Minute Read

Featured

Alpha Creation Kiya Kya?

Which client has ever asked you, "What is your alpha?"

No one has ever asked me that. Not once.

And yet, alpha is one of the most important concepts in our industry. It’s the ess ....

Read More

4 February, 2025 | 5 Minute Read

Featured

The Great Budget Tamasha

Every year on 1st February, everyone is glued to the television like children sit when someone is handing out candies. There is a mad rush by people to sound intelligent, give quot ....

Read More

1 February, 2020 | 2 Minute Read

Featured

The Celebrity Client

Recently, one of our partners shared an inspiring story with me. It speaks to the essence of what we stand for at HF. Here’s what she wrote:

"Hi Amar,

Trust this email finds you ....

Read More

1 October, 2024 | 5 Minute Read

Featured

Moths and Your Direction

There is an interesting story about moths that I read in Ozan Varol’s book, “Awaken Your Genius.” What struck me about this was the striking resemblance to the evolution of o ....

Read More

25 July, 2023 | 6 Minute Read

- 0

- 1

0 Comments