The S-Curve

Amar Pandit

A respected entrepreneur with 25+ years of Experience, Amar Pandit is the Founder of several companies that are making a Happy difference in the lives of people. He is currently the Founder of Happyness Factory, a world-class online investment & goal-based financial planning platform through which he aims to help every Indian family save and invest wisely. He is very passionate about spreading financial literacy and is the author of 4 bestselling books (+ 2 more to release in 2020), 8 Sketch Books, Board Game and 700 + columns.

March 21, 2023 | 5 Minute Read

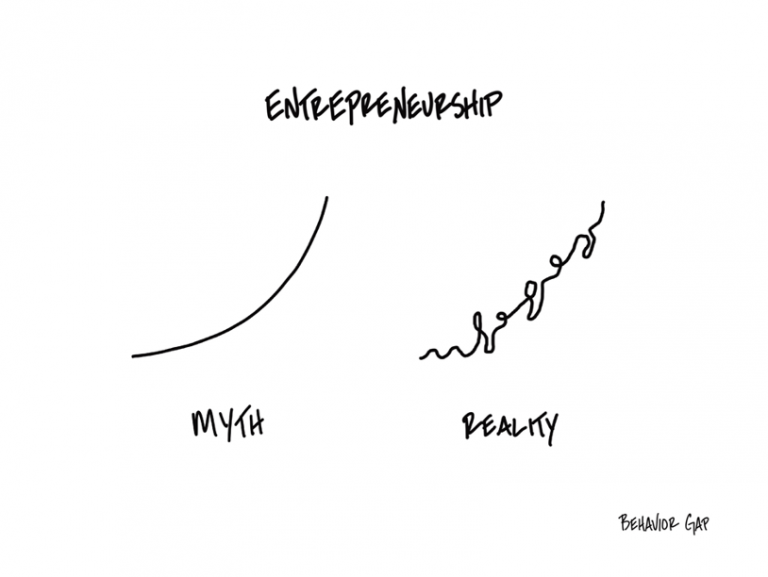

I got some amazing responses to last Friday’s Nano “What are you Paid For?” In case you haven’t checked it out, I strongly urge you to check it out and reflect on it. Now before I get into the S-Curve, let me share with you yet another curve – one that you are likely to be familiar with- the Hockey Stick one.

This curve is however one of the bigger myths of entrepreneurship. The truth is that building a successful business is messy and super unpredictable. Look at what’s happening around in the global banking industry– Silicon Valley Bank (was the 16th largest and profitable bank) and now the 166+ year old financial services giant Credit Suisse. Every business (no matter the size) hits barriers, challenges arise, and people disappoint you. Things never go as planned. You have good breaks and bad breaks. There is no hockey stick. There is only a chaotic and unpredictable line between here and there. And this line can be understood through the lens of a S-Curve.

Donald Miller in his book “How to Grow your Small Business” wrote, “Every successful business (no matter the size) has come face to face with the s-curve. This curve follows a specific pattern- the business begins to grow, which is a great thing, and then a series of events that could make or break a company is put into action.”

Are you facing the S-Curve too?

If you are human like the rest of us, I bet you are already on this curve facing growth barriers (at different levels of Assets Under Management and Size of the team). There is no denying that. Of course, you have a choice – to lie to yourself and pretend like this is not true.

Donald further added, “Imagine a business puttering quietly along- the first part of the s-curve. Then, the products begin to sell. Demand might even soar. It’s magic. The business begins to grow. Customers like the product and they start telling their friends (aka referrals). Everything is great right? All the business owner’s problems seem to be behind them.

But then, things take a turn.

The business owner is pulled out of the sweet spot, the sweet spot they were in when the company took off. They spend too much time trying to put out fires, and the business starts to decline because the owner is managing problems rather than continuing to create the magic that grew the company.

Then the problems get worse. They hire too many people because they anticipate growth. They extend discounts and offers to attract more business. They allot too much money to marketing that doesn’t work. Customers feel the effects of product delay. There is frantic messaging and bad customer service. Sales begin to decline…”

Does some of this sound familiar to you?

The reality is that every business goes through some version of this. Might not be exactly in the same order but every business does go through this. Yours too.

All of this despite the fact that we have a powerful offering that people want. How in the world can something like this happen to us?

The answer is we let it happen to us because we lie to ourselves about things going great. Our SIP book and Market appreciation transports us into sloppy thinking (and a place of complacency). Needless to say, we make ourselves comfortable in a Denial Zone.

So how do we then get out of this and start overcoming the growth barriers?

While I have written about many of these things in my book “The HappyRich Advisor”, there is simply too much to cover in this post (which we intend to do on a regular basis in a very custom way for you in our Mastery School for Real Financial Professionals – HRAC– Do check it out).

However, at a broad level, the answer lies in professionalizing your business. Moving FROM a set up where you are working IN the Business and Rarely ON the business TO ONE where you have struck a balance or rather work on things that you are most impactful at. Thanks to the power of leverage – processes, technology, client experience, people and capital. And if you can’t leverage this on your own then the next operating word is collaboration.

If your strength lies in meeting prospects and clients but you suck at operations (like I do), then all you should be doing is meeting prospects and clients while at the same time getting someone to build a world class operations team. If you excel in creating content, shouldn’t you be focused on doing what you do well. How about marketing? The point I am making here is that a LONE WOLF MODEL is not the recipe for growing your business and creating value in it.

There are simply too many variables at work…Your Vision…Your Purpose (why do you even exist), Your Story…How does your Strategy then align with your Vision, Purpose and Story…And the list continues.

In her book “Growth IQ”, Author Tiffany Bova wrote, “When asked what slows growth, it might surprise you to learn that most executives actually cite internal factors. In a Bain & Company study, 85% of the executives surveyed, and a full 94% of those running companies with more than $5 billion in revenue, said that internal, not external, obstacles keep their companies from growing profitably. What a shame; after all, it is the internal factors over which you are supposed to have control- as opposed to moves by your competitors, market shifts and even Black Swan events.”

On the topic of Black Swans, I would encourage you to check out my posts on www.happyrichinvestor.com blog “The Black Swan Season” and “The Lessons.” Feel free to share it with your investors and clients.

Coming back to the Bain study, what is it for you? Are your growth obstacles internal or are they external (markets, competition, regulation)?

We all know the answer to this one but whatever your answer might be, don’t be lulled into taking the easy route. For if you want to beat the S-Curve, there are really no easy answers, shortcuts, tips and hacks (and it’s different for you at different points of time in your journey to becoming a world class modern firm of the future).

Similar Post

Growth

From Forests to Firms: Mycorrhizae as a Blueprint for Sustainable Growth

In their book, CEO Excellence – The Six Mindsets That Distinguish the Best Leaders from the Rest- Authors Carolyn Dewar, Scott Keller, and Vikram Malhotra wrote, “Walk through ....

Read More

2 July, 2024 | 5 Minute Read

Growth

The Grand Inversion

Though I knew this concept intuitively (as the design of the HF ecosystem has been based on this one), I found a fancy name for it when Mike Sha, Founder - SigFig (a US WeathTech F ....

Read More

21 June, 2022 | 5 Minute Read

Growth

Part 2 Unveiled: Mastering Sales Productivity Ratios for Growth

Picking up from where we left off in our deep dive into the metrics that define success in our industry, today we're continuing with Part 2 of 'Unlocking the Metrics of Success'. W ....

Read More

6 February, 2024 | 7 Minute Read

Growth

The Power of Story in your Work

What comes to your mind when you hear the word “Story”? Chances are you might think of fiction or drama or a movie. Media folks think of it as something to report or write abou ....

Read More

24 November, 2020 | 6 Minute Read

Growth

Unlocking the Metrics of Success

Let me ask you a simple question – What are the metrics of success in our industry/profession?

Just answer this instinctively.

The most common answer – Assets Under Manag ....

Read More

30 January, 2024 | 7 Minute Read

- 0

- 0

0 Comments